The South Simcoe Police Service is Protecting a Loanshark

Related story: June 28, 2023: Special Fraud Detective To Launch New South Simcoe Police Investigation Of Brokerage Loansharking

A little more than a year ago, we posted a story called “Loansharking in Lefroy?” It can be found at HTTPS://www.fivepointsmedia.ca/verico-the-mortgage-station-loansharking-in-lefroy.html. To this date, 370 days later, no representative of Verico the Mortgage Station, the company at the center of allegations of usury, has taken action to remove our allegations. If we were lying or inaccurate in our claims, lawyers for this provincially regulated financial company could have silenced us through a cease-and-desist order through legal action in the Superior Court. They could have also attained an order of costs against us and demanded that we post a retraction and an apology.

Don’t you want to know why this business that works on trust regarding your finances did nothing to protect its “good” name?

Despite our very public and well-read allegations of having committed an offence under Section 347 of the Criminal Code of Canada, which is punishable by a prison sentence of up to five years, we have never received so much as an email from any of the brokers asking us to remove or retract our allegations. Now we know why the brokers at Verico the Mortgage Station were not too worried about breaking the law in the jurisdiction of the South Simcoe Police Service.

What police called an “investigation” this past week was in reality a one-sided whitewash of the truth and a deliberate decision to ignore easily accessible evidence.

I waited a year for David Flude, the lead broker at Verico the Mortgage Station to complete what he said was a “regulatory required” investigation into my allegations. A full year later I had heard nothing from him and had received no report that he claimed had to be filed with the Financial Services Regulatory Authority of Ontario (FSRA).

Remember, these brokers are entrusted to work with your life savings, and yet for some unknown reason they are free to lend money at grossly illegal levels of interest and to disregard their own “regulatory requirements”.

Section 347 of the Criminal Code of Canada sets the maximum allowable annualized interest that may be charged at 60% – interest charged above that level is considered usury and is a criminal offence.

347(1) Despite any other Act of Parliament, every one who enters into an agreement or arrangement to receive interest at a criminal rate, or receives a payment or partial payment of interest at a criminal rate, is (a) guilty of an indictable offence and liable to imprisonment for a term not exceeding five years; or (b) guilty of an offence punishable on summary conviction and liable to a fine not exceeding $25,000 or to imprisonment for a term not exceeding six months or to both.

It is easy to understand why the brokers at Verico the Mortgage Station would want to ensure by whatever means was necessary that the police would not properly investigate these fully supported allegations.

Earlier this month I asked for a review of a decision made last year by the Criminal Investigations Unit of the South Simcoe Police Service that had shelfed my complaint of usury against Renee Dadswell, a broker at Verico the Mortgage Station. The reason it had been set aside is that I could not provide a copy of the loan agreement or promissory note that had been promised to me by broker Lisa Purchase, but which had been illegally withheld despite my having asked for it several times. I am now working through the Canada Revenue Agency to obtain the note.

Apparently, all you have to do to get away with an indictable offence in the jurisdiction of the South Simcoe Police Service is to withhold the evidence of your crime – well, at least if you are affluent and influential.

In my letter to Chief John Van Dyke, I explained that we are reopening the subject matter as we are now producing a documentary intended for broadcast and streaming media that will be seen across the country. The program, about Pandemic Profiteers, will include several stories ranging across various businesses and areas of service. Chief Van Dyke was very polite, replying to my email personally and informing me as follows: “I have reviewed your email and supporting documents and have tasked Inspector Julio Fernandes, who is the senior officer who oversees our Criminal Investigation Branch, to review our investigation to date into your allegations.”

It did not take long to learn that the brokers at Verico the Mortgage Station, who claim sales of $5 million a year, yield influence within their community, and were very well protected by at least one detective.

Inspector Julio Fernandes advised me in an email that Detective Constable Andrew Smith had been assigned to the case and had reviewed the file and spoken with the brokers at Verico the Mortgage Station. That ‘detective’ had also accepted on blind faith all their claims and documents, including statements and claims that fly in the face of the official documents that I had presented.

Detective Smith had also completely ignored me as part of his “investigation” as he did not meet with me, speak with me, nor in any way communicate that he was investigating the matter.

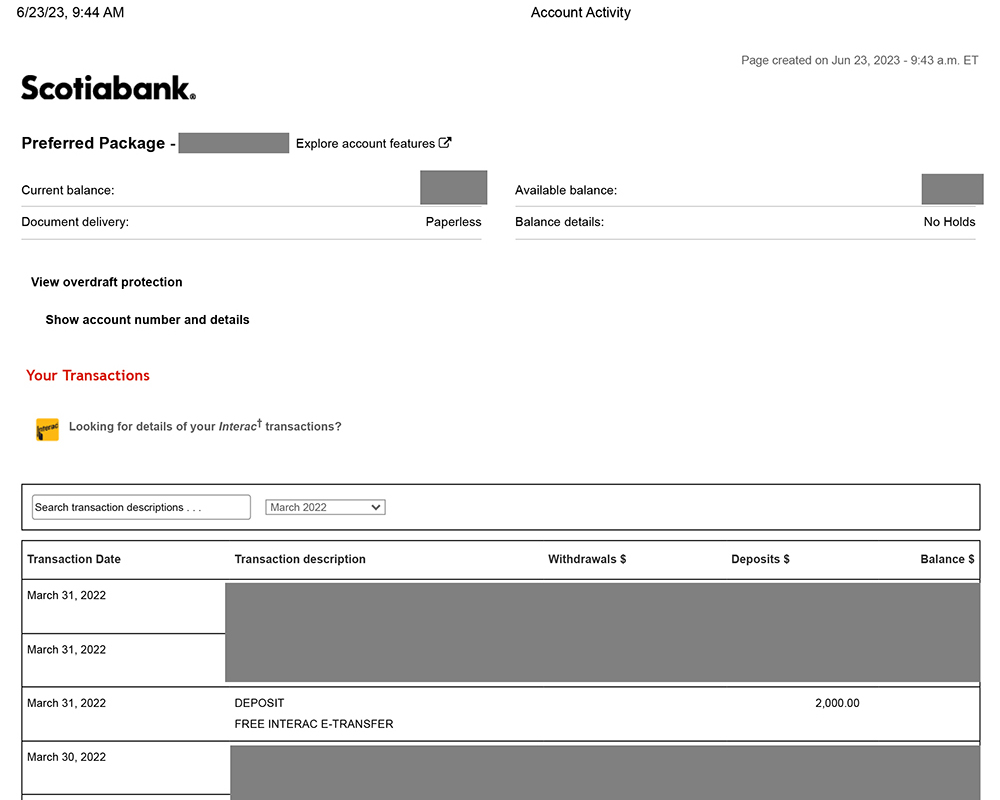

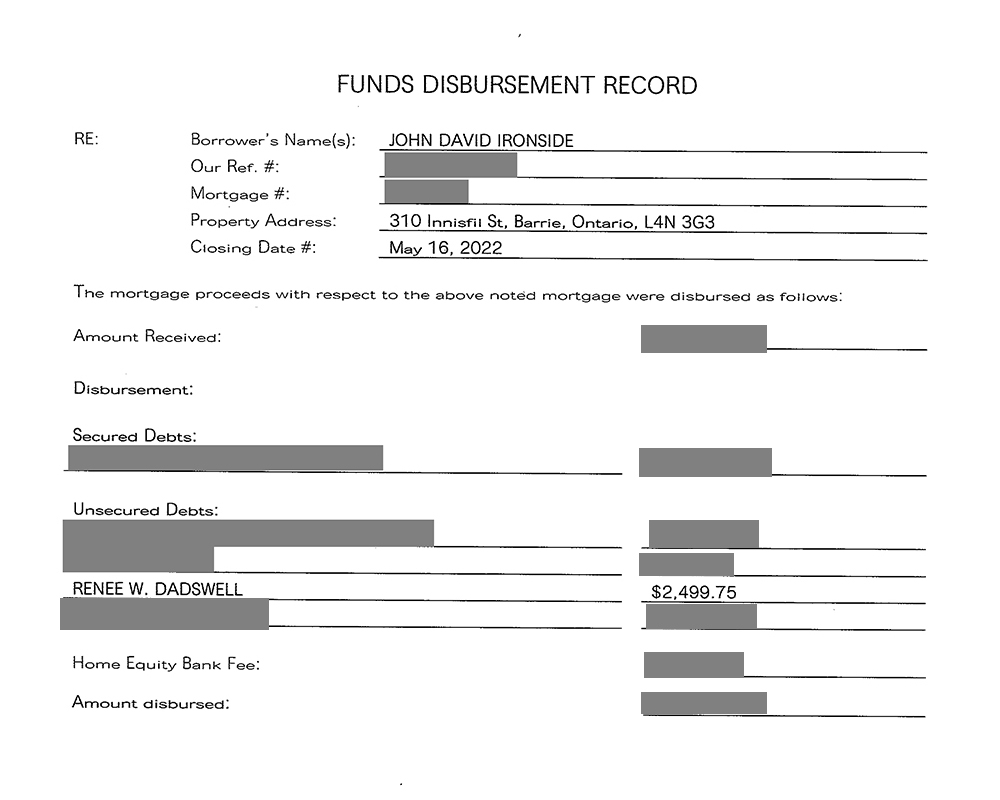

My allegations are that Renee Dadswell had loaned to me the sum of $2000,00 on March 31, 2022, and that when my mortgage finally cleared on May 16, she was paid by the brokers at Verico the Mortgage Station the sum of $2,499.75. I established this through a bank statement and a copy of the trust ledger and commitment page of my mortgage that was provided to me by Verico the Mortgage Station. Both are included here.

Bank record showing the loan payment by Renee Dadswell

Mortgage disbursement record showing the amount paid to Renee Dadswell

The math shows that I was charged $499.75 for a 46-day loan, representing an interest rate of 10% per month or 120% per year, plus a $200.00 “administrative fee”.

In his email of June 22, 2023, Inspector Julio Fernandes stated as if fact: “The listed interest rate in the Promissory Note agreement is 12% per annum, and it is compounded at the rate of 1% per month – this is nowhere near the 60% threshold that would make the interest rate criminal.” He also noted as if fact a series of untruths ranging from how I received the money to why I had approached Verico the Mortgage Station for a mortgage. I also asked for a copy of the Promissory Note that Inspector Fernandes said confirmed I had agreed to the interest rate claimed by the brokers of Verico the Mortgage Station but he did not reply. I have no doubt it is because the document has been altered or that the signature on it is not mine. There is no reason for either the brokers of Verico the Mortgage Station or the South Simcoe Police Service to deny me that document that they claim bears my signature.

If the brokers of Verico the Mortgage Station did, in fact, produce a document making those claims regarding the interest charged, then they should also be investigated for falsifying evidence and obstruction of justice, which are indictable offences.

In a follow-up response, dated June 23, 2023, I noted: “I am going to guess that none of us are accountants, but I checked and 1% of $2,000.00 is $20.00. I also counted the days between the two dates to total 46. So, approximately one and a half months at 1% interest per month or 12% per year would be about $30.00. Even at the 10% (per month) that I was told I would be charged, that totals approximately $300.00 in interest. I must admit that it has been a long time since I did compound interest calculations, but I cannot account for why the sum of $499.75 was dispersed to Renee Dadswell. If the money was not for a usury level of interest to Renee Dadswell, as is refuted by the brokers at Verico the Mortgage Station and believed on blind faith by your detective, then the company simply stole $429.75 (corrected later to $469.75) from my mortgage and dispersed it to Renee Dadswell as an act of fraud. If that is the case, then I request that the South Simcoe Police Service initiate an investigation of fraud against Renee Dadswell, Lisa Purchase, and David Flude.”

Neither the brokers at Verico the Mortgage Station nor the very biased detective can have it both ways.

The math does not lie.

In exchange for the loan of $2,000.00, which was outstanding for only 46 days, I was charged $499.75. That represents an interest rate of more than I originally calculated, which I then realized was the “administrative fee” that even Inspector Fernandes acknowledged “The administrative fee that was initially charged was done so in error and was refunded, had this not occurred the lender would have run into a regulatory issue as the total borrowing cost would have exceeded what the regulations permit.”

Regardless of the reluctant return of the "administrative fees", the amount charged as interest, that being 120% per year, is twice the legal limit.

The $200.00 “administrative fee” was not an accident as was suggested by Renee Dadswell in an email dated June 14, 2022, almost a month after the mortgage had cleared and she had illegally charged me usury levels of interest. “It has come to my attention that you have indicated a problem with the promissory note that was signed by you on March 30th, 2022. This was for a personal loan in the amount of $2,000.00 which you received from me. In reviewing the document, you are correct in stating that since the term stated was very short, that the amount of the administration fee would exceed the limit of an allowable cost of borrowing. As a result, I have sent an email money transfer of $200.00 to your bank account, (automatic deposit) which is the administration fee that was originally charged. This was done today at approximately 2 pm.”

In my reply of the same day, I noted: “It does not matter that you paid back the interest. The offence still occurred. Your action now is essentially an admission of guilt and is no different than a burglar offering to return what they stole in exchange for not being charged with a criminal offence . . . You have tried to do the right thing by sending back the interest on the loan. However, let’s be honest, this was not done out of the goodness of your heart.”

This is a clear-cut case of usury, also known as loan sharking, and it is a crime that is punishable by a prison term of up to five years, yet the South Simcoe Police Service is pushing hard to brush it under the rug.

It has to be asked, what could motivate a detective of the South Simcoe Police Service to come so transparently to the assistance of a multi-million-dollar business that has influence within their community but which will not defend their “good name” through action based on evidence in a court of law? They have also refused for more than a year to file their side of my allegations with the Financial Services Regulatory Authority of Ontario (FSRA) even though doing so is a “regulatory requirement”.

What is the cost of justice within the jurisdiction of the South Simcoe Police Service?

If she is charged and convicted for usury based on the evidence, Renee Dadswell will likely never see the inside of a jail cell. She is affluent and has influence and would likely plea to lesser charges. Regardless, as she will have been shown to be unethical and untrustworthy, as have the other brokers of Verico the Mortgage Station who have covered for her, they will likely all lose their licenses to work as mortgage brokers. They could also be sued by VERICO Financial Group Inc., the Home Equity Bank, or any of hundreds of other independent Verico brokers whose names are being dragged through the mud by association. All are legitimate components of this story, as we want to know if Verico the Mortgage Station is working alone or in line with corporate policies.

That is a lot of motivation for the brokers at Verico the Mortgage Station to help ensure the detective sees things their way.

Another reason for such a biased “investigation” through which Detective Smith did not even speak with me, could be that we are a progressive publication that supports causes that are often in truth not favoured by the police. Some examples are support for the homeless and the LGBTQ community and equality for all races. I also published a series of articles a few years ago involving a local Barrie detective whom I showed had abused his authority to try to silence me from reporting on the apparently illegal actions of a local politician.

That detective went so far as to file false claims so he could incarcerate me in Penetanguishene for a few days because I would not sign the “conditional discharge” he kept trying to coerce me to “agree” to sign that required that I not report on the story.

I pushed the allegations to trial, and along the way, the Crown Attorney dropped multiple charges that had no substance. Finally, when placed before a judge, all charges were dismissed as violations of my rights under the Charter of Rights and Freedoms. The last time I saw the ‘detective’ he was in uniform and not wearing a sidearm which suggests he was working in administrative duties or guarding the cells. Neither would have been an indication of advancement for this officer who had once been highly respected in the Barrie Police Service. Since then, we have worked to rebuild our relationship with the officers of the Barrie Police Service and have in fact produced several community videos with both former Chief Greenwood and current Chief Johnston.

Police stand together, so they would not likely be eager to assist somebody who could be seen as having disgraced a fellow officer.

If you need proof of this, consider the following:

- At an event in support of a women’s shelter, I was physically assaulted by an unlicensed and non-uniformed “security” guard almost immediately after I started recording the arrival of the previously noted corrupt politician. The entire incident was recorded, but the officers of the Barrie Police Service who I had called refused to charge the assailant.

- During the pandemic, when we were discrediting the anti-masker movement, an unidentified assailant drove by our studio three separate times over a two-month period and fired a rifle at the windows of my van and at the front window of our studio. Their efforts resulted in two shattered back windows, a hole in the windshield, and also a hole in the front window of the house. We provided 4K quality surveillance video to the detective who was eventually assigned, which he said was the best he had ever seen. He also noted that the car was older and that there would not be many on the road. Regardless, the case just fluttered away and despite the obvious risk to public safety, the drive-by shooter was never caught.

Through their one-sided investigation, the South Simcoe Police Service, like their counterparts in Barrie, show that they serve the law as suits their best interests.

The evidence here is clear. Interest charged at 1% per month or 12% per year for 46 days, as claimed by the brokers of Verico the Mortgage Station and accepted on faith by the South Simcoe Police Service, totals about $30.00. Meanwhile, if the interest is charged at the criminal level of 10% per month or 120% per year, as I allege is the case, then the total comes to about $300.00. That is what I was charged plus an “administrative fee” of $200.00 that I never agreed to and which was later returned only after I advised the brokers of Verico the Mortgage Station that the charge was illegal, which has now been acknowledged as true by Inspector Fernandes.

The evidence was also reviewed by both Detective Smith and Inspector Fernandes, but apparently, neither of these highly paid investigators can handle grade-five math.

So, is this a case of an honest mistake, or somebody on the take? The evidence is overwhelming and cannot be ignored by Detective Smith, Inspector Fernandes, or Chief Van Dyke. Official documents from a bank and from Verico the Mortgage Station confirm that Renee Dadswell charged an illegal level of interest on a loan that was required only because the brokers of Verico the Mortgage Station had dragged out the process of my attaining that mortgage to such a point that it almost bankrupted me. They dragged out a three-week process to nine weeks without explanation while knowing that I had invested huge sums in building a studio from which we could create television shows through our not-for-profit community channel in support of local charities and benevolent community groups.

So, who are the detectives and Inspectors of the South Simcoe Police Service going to support; the multimillion-dollar brokerage, or the not-for-profit that donates thousands of hours to their community?

Detective Smith spent most of his report disparaging me and even dropping in some choice insults, which clearly showed his investigation was completely biased. In response, I noted: “I run a community-focused not-for-profit that donates all services to charities, benevolent community groups, not-for-profits, and our city and yours. I make no money from this labour of love, and the expenses often cause bumps in my finances. The value of these fully donated services exceeds $600,000.00, and in 2020 my crew and I were voted to the finalists list for an award for altruism being presented by the Barrie Chamber of Commerce and the City of Barrie. When your “detective” can claim similarly then he can call me names. We are not all money motivated. HTTPS://www.fivepointsmedia.ca/testimonials.html”

The stakes in this matter are much higher than just the story about how I was defrauded by the brokers of Verico the Mortgage Station.

Consider how easily and willingly Renee Dadswell loaned me the $2,000.00 and how casually and expertly the brokers of Verico the Mortgage Station charged me a rate of interest that was double the amount needed to obtain a conviction for usury, plus an “administrative fee” of $200.00 that she eventually, and reluctantly, returned. Consider also how cavalier the detective of the South Simcoe Police Service was regarding his obligation to speak with me as the complainant instead of blindly following the orders of those I had accused. Also, although I cannot substantiate the verbal claim, Lisa Purchase advised me that this was not the first time they had made such a loan arrangement.

If we have anything to say about it, I will be their last.

How many young families, new immigrants, seniors, and other soft targets have been taken advantage of by the brokers of Verico the Mortgage Station? How long have these brokers been getting away with taking advantage of people and how long have the officers and detectives and command ranks of the South Simcoe Police Service been motivated to look the other way? What is the cost of doing business within the jurisdiction of the South Simcoe Police Service? How many dozens or hundreds of people have been obviously defrauded but could not fight back because the South Simcoe Police Service were blatantly biased in support of the loan shark?

Well, as has always been my choice in the past, my crew and I are taking on the challenge.

Our crew's investigative journalism has caused the ultimate bankruptcy of two multi-million-dollar companies, simply by reporting the truth about how they were defrauding their employees and abusing the intent of the civil and criminal justice systems. One spent $400,000.00 in hiring nine lawyers from three Bay St. law firms, and they still lost, crawling out of the courtroom after begging to be permitted to drop their case. They also lost about half a million dollars in business due to our reporting of the truth. We have also exposed unethical politicians at various levels of government, resulting in at least one incumbent losing his seat at the provincial election. We also managed to get his muckraker, a twice-judged defamatory libelist, to be ruled a vexatious litigant. We did all that through the presentation of evidence, often while the other side resorted to slander, defamation, and the manufacture of false evidence. We have also been instrumental during the past few weeks in forcing the Council for the City of Barrie to rescind their plans to approve bylaws that would essentially make homelessness illegal and kindness a crime.

We are well-known, mostly in Barrie, for standing up for those who do not have a voice, so this subject matter lines perfectly into our mandate to help the disadvantaged of our community.

Bell Media, the owners of CTV, are applying to the CRTC to be exempt from the requirement to create local content. That means that if approved, Barrie will no longer have a locally-focused television news service. Other local media, like online newspapers, will not report on stories like this for fear of losing advertisers or being sued, and radio stations, generally speaking, only regurgitate what comes in on the wire or in press releases. We have no sponsors and are self-contained. We also have a reasonably impressive history of winning in civil court, both in Small Claims and the Superior Court. It is in the halls of our justice system where evidence rules, which is why we are so successful even against an army of highly-experienced lawyers. We don't lie, and we only publish that which we can prove.

This means that we are the only uncontrolled media in Simcoe County that will publish or produce video content about stories others fear to report.

My background is in international news, working with groups like Greenpeace and reporting in war-torn regions like Bosnia and the Middle East during the first Gulf War. I have been sued several times for libel as a means of intimidation, but have won every claim based on the evidence, and have been awarded tens of thousands of dollars in costs. I have been arrested and imprisoned for telling the truth based on allegations that were later thrown out of court as being abusive tools of intimidation and violations of my rights under the Charter of Rights and Freedoms. Regardless of the threats, my crew and I have never backed down.

The truth is what it is and our crew will report the facts and present the evidence to support our stories.

In his email to me, Inspector Fernandes noted that despite the massive quantities of evidence sent to his officers, which included an emailed acknowledgement of accountability from Lisa Purchase, and the decision by Detective Constable Smith to not even speak with me, “Your claim of a criminal interest rate is unfounded, and it has been determined that you are not the victim of a crime (criminal offence).” This “investigation” as undertaken by Detective Constable Andrew Smith of the South Simcoe Police Service, is in my opinion, a cover-up that needs to be investigated by the Ontario Provincial Police Financial Crime Division and/or the Office of the Independent Police Director. Despite my having responded several times to that email, neither Inspector Fernandes nor Chief Van Dyke has responded.

The South Simcoe Police Service has a long way to go before it lives up to its motto of

“Protect with Courage, Serve with Compassion”

John Ironside

Producer/Publisher, Five Points Media