Improvements Boost Awareness About Broker Usury During The Busy Spring Mortgage Season

A few of our regular followers immediately noticed that last night we made some minor changes to the operational side of our website, most obviously in the form of a date-optimized drop-down menu. We did this to gain room for more articles and videos, as clearly, the brokers at Verico the Mortgage Station are intent on continuing to hide from their own criminal and ethical abuses, and it now seems inevitable that this story will go the long way around to get to the full truth. That is 100% their choice, and clearly, they don’t care if their mortgage funding companies get hurt in the process, as has happened to the reputation of HomeEquity Bank.

However, what you don’t see will have more impact.

As is true of all parts of this story, the changes are all being made because David Flude and his brokers Renee Dadswell and Lisa Purchase are determined to drag this story, and everybody with whom they do business, down a one-way rabbit hole to financial losses rather than face reality and take responsibility for what they did.

That is a very special form of cowardice.

As journalists, we have seen this pattern before, twice in fact, and in both cases, the prideful perpetrators held on, confident in their ability to con others, right up to the point of losing it all and being closed down due to too many people learning the truth about who they really are and what they had done. That process of education took 32 months in one case and 34 in the other, but in the end justice was served. Similarly, when a slumlord's negligence contributed to the death of a disabled man who was renting an illegal uninsulated trailer during the dead of winter, our coverage compelled the City of Barrie to take action and ultimately the fines and exposure forced him to sell the house at a loss as everybody by that point knew who he was and why he was selling.

Everybody can see that we have tried to be fair.

Not only have we offered the supposedly ‘trustworthy’ brokers the opportunity to present their side of the story, but we have even offered to cancel the documentary and remove all website and social media posts if they can show through the presentation of tangible evidence during a video-recorded interview that we have in any way erred in our reporting. We have also offered them a ‘without-prejudice’ meeting for this purpose, but even that offer was insufficient to drag them out of the shadows.

There are a lot of people in Simcoe County who feel grateful to us for reporting on this story and exposing the criminal and ethical abuses of the brokers of Verico the Mortgage Station. We know the brokerage is losing income because at least 40 people or families told us they went elsewhere based solely on our fully supported reporting. We have no reason to believe that number is anywhere near the full list of lost clients. Statistically, it likely represents about five per cent or less, as most people do not want to discuss their financial choices with a journalist. Meanwhile, as a way to say thanks to us for having potentially saved them from financial harm, we are receiving offers of financial donations, the suggestion of a union-backed picket outside the brokerage, thank you messages of every kind, and requests for quotes for professional video services from people working in fields related to the mortgage industry, and others who just like our videos as presented in this ongoing report that they are following along with many others. This is the result of honest people seeing truly philanthropic journalists risking repercussions to protect potentially vulnerable seniors from potential fraud by usury, or loan sharking. Meanwhile, they can see on the other side of this story, how the accused are hiding in the shadows practically screaming they are guilty. As far as we are concerned, the brokers of Verico the Mortgage Station and the management team at HomeEquity Bank can hide from us and the truth of their offences for as long as they wish.

Their self-abusive delays are hurting them, not us.

There is only one reason why the owners of a multi-million-dollar brokerage and their allies from a multi-billion-dollar bank would hide from and refuse to meet with the producer of a small, not-for-profit media company that is dedicated to helping the most vulnerable of its community.

What you don’t see in the website improvements is how we have also optimized our keywords across all reports. Those more effective standardized references were generated through an online AI analysis of websites for hundreds of Canadian mortgage brokers and lenders and how they relate to the content of our reports. This upgrade will greatly help us to warn more seniors seeking a CHIP Reverse Mortgage and families seeking any kind of real estate financing. Our goal remains to warn potential clients how the brokers at Verico the Mortgage Station charge illegal levels of interest on short-term financing to their potentially vulnerable senior clients, which is a crime known as usury, or loan sharking, that carries a punishment of up to five years in prison.

Today, we will be upgrading the Search Engine Optimization on the videos hosted on our YouTube channel to improve the search results, even though they are already flying high on page one of most search engines.

We will also be improving the Search Engine Optimization of both platforms through new techniques that were previously unknown to us. Currently, nine references to our reporting appear on page one of Google when searching ‘the Mortgage Station’ and soon, there will be very many more. According to split testing results, those changes are already having a significant effect. Of course, much of this new success is the result of the assistance of an unidentified online promoter who is helping to boost our story, most likely for their benefit more than ours. We checked and can confirm that he or she immediately updated the information on Google and other search engines.

That resulted in four different spider and robot searches of the entirety of our content by Google and others.

We have not implemented all the updates that the SEO specialist suggested, as our story about loan sharking and pathological lying to avoid investigation at Verico the Mortgage Station is currently being told through our community channel, which is dedicated to socially relevant stories and charitable services. We will be utilizing those tips when the new domain www.themortgagestation.tv goes online fully, which will happen sometime during the holiday period when we have more time. The pages included here will be left as they are when it comes to content but will be updated to automatically forward the user to the appropriate page on the new domain.

Our reports and videos have been viewed by about 750,000 people so far, so we are focusing more now on quality than speed.

Earlier this week, we published a public list of the lenders who choose to do business with these fully exposed loan sharks, who have chosen to hide for 18 months rather than defend their name, file action in civil court, or seek injunctive relief to stop us reporting about their crimes and violations of the ‘regulatory requirements’ of their governing body, the Financial Services Regulatory Authority of Ontario (FSRA).

So far, nobody has come to their defence regarding this childish ‘strategy’ of tuck tail and hide.

We include that list again below, as although several have reached out to us seeking evidence and more details, which we are happy to provide, they are all now accountable for knowingly working with the loan shark brokers at Verico the Mortgage Station who present a real and present danger to often vulnerable seniors, and the less knowledgeable members of our society such as new immigrants.

Two of the lenders did not provide an email address online, and one accepted only internal mail and approved senders. However, we managed to reach and receive delivery receipts from the following lenders:

We emailed them all the crucial details, and we included multiple direct links to our reports and the evidence, and we have the receipts of their accountability.

We have already also received enquiries from working people who have invested money in the mortgage lending fund of one of those banks or investment companies. It is not surprising that many of them are following this story and spreading the truth. Most people do not have a lot of money to invest, and a story about loan sharks working in the mortgage world would catch their attention, especially if the details include the name of the corporation in which they invested their hard-earned money.

We expect that level of interest to increase based on the new keywords used to promote each article and posts we have been told were added to investor social media pages.

These banks and finance companies know the dangers of our reports being found by competitors and mainstream media. Now that they are informed, they can no longer feign plausible deniability. So, if they choose to continue to work with the loan shark brokers at Verico the Mortgage Station, as was the erroneous decision of HomeEquity Bank, we will exercise our right as journalists to warn their potential clients of the risks associated with that ongoing relationship. That may not concern the financiers, but past stories reported by us about other corrupt multi-million-dollar corporations resulted in both going out of business because their associates bailed on them in their own best interests when the facts were fully presented to the public.

Investors have a right to know the truth, and to see that the brokers at Verico the Mortgage Station will not defend against, nor take action to stop us from reporting the truth.

We are now researching the twenty listed lenders, with our goal being to uncover any controversial reports in mainstream media or complaints filed with the Financial Services Regulatory Authority of Ontario (FSRA). That information will then become part of our narrative and also an issue of interest in our documentary that is currently in production for broadcast television and streaming services.

Those “regulatory requirements’ are put in place to protect clients of brokerages from crimes like usury, or loan sharking, but David Flude did not seem to believe that they applied to him.

The simple truth is that this story, about the exposure of the crimes of the brokers at Verico the Mortgage Station and the involvement of the lenders, never had to happen. Eighteen months ago, David Flude had a single ‘regulatory requirement’ to complete a report for the Financial Services Regulatory Authority of Ontario (FSRA) and submit it to the agency. However, the Principal Broker of Verico the Mortgage Station did not want to have to explain how Renee Dadswell had committed the crime of usury, which is an indictable offence that is punishable by a prison term of up to five years, or how Lisa Purchase dragged out and delayed the ‘three-week’ mortgage process to nine weeks to force the mark, our producer, to be forced to accept the illegal terms of the financing, and to coerce him to accept a private mortgage at a much higher rate, which likely meant more commission being paid to her.

In retrospect, this game of stall and delay is a classic squeeze con, but when you are in the middle of the sting you often don’t see what is happening.

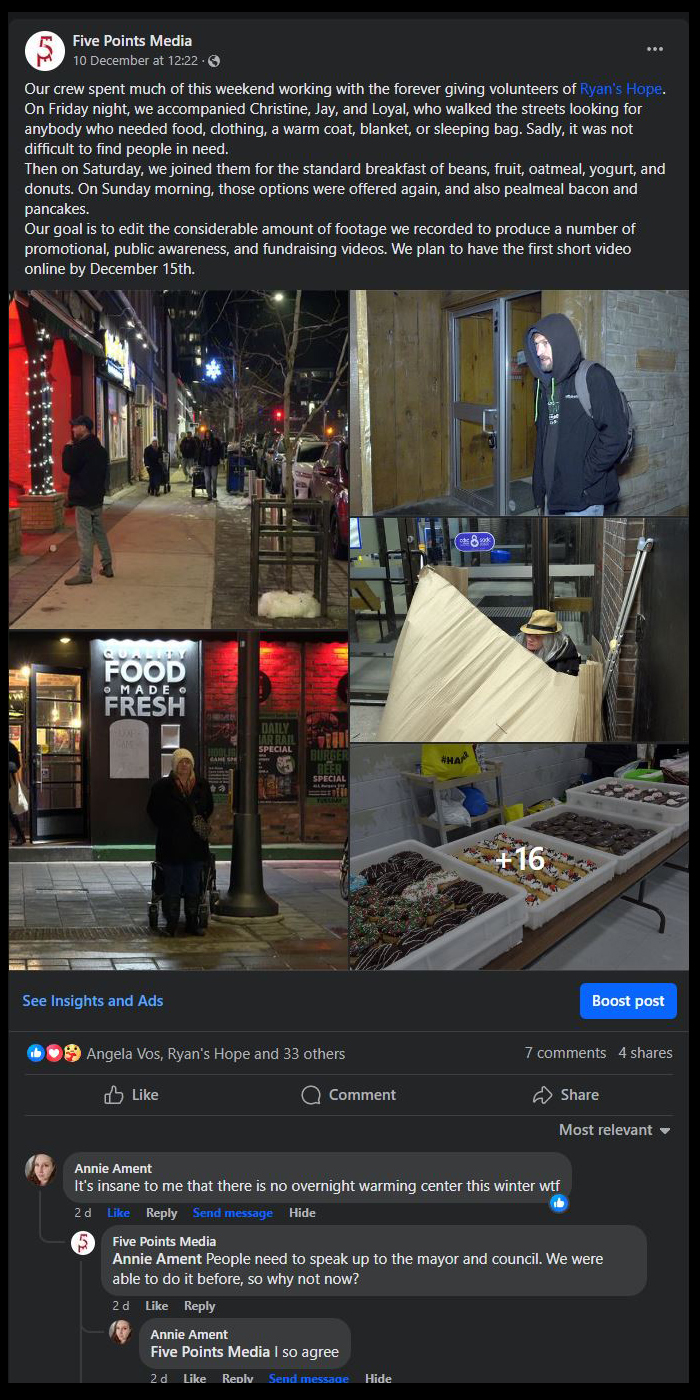

For three days over the weekend, our crew donated services, recording the charitable work of the volunteers of Ryan's Hope as they reached out to support the homeless community in Barrie. Our recordings will be edited into a fundraising video for the holiday season and also a documentary that will be used to educate the public about this growing threat to so many people. The value of our donation will be around $3,000.00, but we never ask for a cent. No matter what David Flude or his brokers have said about us to cover for their own criminal and ethical abuses, this is who we are, and it is the reason we are not afraid to challenge the rich, the corrupt, and the dishonest in our society.

The brokers at Verico the Mortgage Station knew when they started their games that our producer is a philanthropist who has donated more than $700,000.00 worth of services to our community through the creation of 350 fully donated videos given free of charge to more than 180 charities, not-for-profits, and benevolent community groups. They also knew that in 2020, at the height of the pandemic, our production team was nominated and voted to the highest level for an award for altruism presented by the City of Barrie and the Barrie Chamber of Commerce.

They also knew that their con and usury would damage that charitable work, which is financed one hundred per cent by the person they were working together to defraud.

Although they are not likely ashamed of their actions, as that would require some level of empathy and accountability which have not been demonstrated so far, the facts we have reported and supported regarding our commitment to our community is no doubt a concern. Regardless, the brokers of Verico the Mortgage Station seem incredibly comfortable lying about our motives, with David Flude calling our producer an 'agitator' when trying to convince a woman to still hire him after she had seen our articles. That did not go so well for him. That concern for their public image and their desire to cover up their actions with deception would also explain why they would go so far as to ‘motivate’ a detective of the South Simcoe Police Service to omit and falsify evidence. Few people who work in the world of charities and helping others would fight as we are doing, but our producer is also a veteran and he does not stand back and watch as businesses of questionable ethics defraud honest people.

The actions of the detective are currently under investigation by the Office of the Independent Police Review Director and are expected to be assigned to the Ontario Provincial Police Financial Crimes Division.

The busy season for mortgages starts following the holiday season as families look to move to newly built homes during the summer in preparation for the coming school year. Many, if not most, will be coming to Simcoe County from Toronto, and they will be using the Internet and Google to find a mortgage broker. We already hold a place of prominence on search engines, especially Google, and that will only increase exponentially when the new Search Engine Optimized domain goes online. We will also double our exposure through the existing stories that will not be changed or removed, but will be edited to include code that will forward visitors to the new website.

By hiding instead of facing the facts, the brokers at Verico the Mortgage Station chose to extend the timeline of the documentary, and in doing so, greatly increase their exposure.

Instead of taking responsibility, the brokers at Verico the Mortgage Station are trying to manufacture a way out of this mess of their own creation, as a phenomenal number of random people in cities and towns across the province are scrutinizing every article we posted last year about how a Barrie slumlord contributed to the death of a disabled man through the rental of an uninsulated and illegal trailer. Despite their desperation, there is no smoking gun or ulterior motive to be found within the articles which have been read by tens of thousands and were fully supported by hundreds of advocacy agencies that work to help the homeless and disadvantaged. Once again, in that case, we put our cards on the table face up for all to see through online video and articles, and we publicly exposed abuses of the civil justice system as we posted the threat of frivolous legal action, known as a Strategic Litigation Against Public Participation (SLAPP) lawsuit, and our response. We brushed off the threat of abusive litigation using the law as our rapier, and we never heard back ever again from the big bad scary lawyer.

We welcome the service of a legal Statement of Claim as we are the ones who want the evidence to be presented to a Justice of the Superior Court.