This story of the loan sharking mortgage brokers at

Verico the Mortgage Station

is no longer being updated on this page.

Please visit the updates on our new domain at:

www.themortgagestation.tv

Verico the Mortgage Station

is no longer being updated on this page.

Please visit the updates on our new domain at:

www.themortgagestation.tv

You are being automatically forwarded to current page on the new website that is dedicated to this documentary. If this does not occur, please click here

Verico the Mortgage Station Loan Sharking Exposé Documentary - Daily Updates

Index of Stories now online - Use red tab for navigation

We have received requests to make available any small updates as they develop. We have been doing that through social media, but we were surprised to learn how many people do not have direct access to Facebook. Also, the window on our Social Media page is usable but not great. When we move the content of the documentary files to the new domain at 'themortgagestation.tv', sometime during the holidays, we hope to limit the number of Verico the Mortgage Station related posts on our Five Points Media Community Channel pages and provide those posts through multiple social media domains that we have already secured that are more pertinent to the story. Only key updates and posts for boosting will appear on the Five Points Media social pages.

As noted in our ‘Latest News’ section, dated December 28, 2023, the day prior our producer received via email a PDF file entitled “Libel and Slander Notice Ironside”. The document was written by somebody with little if any knowledge of the law, it was not signed, there was no name associated with the authorship, and the email address was generic.

The question we have to ask is who exactly is this ‘brave’ and ‘bold’ issuer of ridiculous rants who hides in the shadows and is too scared to affix their name to their own threats?

Simply Pathetic

Our ongoing reporting of manipulation, loan sharking, and pathological levels of deception at Verico the Mortgage Station is moving to a bigger and more easily navigated space. From this point forward, all new stories will be uploaded only to the domain at www.themortgagestation.tv and not here. The daily updates will be found at https://themortgagestation.tv/latest-news.html and the newest full stories, both written and video, will be available at https://themortgagestation.tv/reports-and-videos.html.

All stories hosted here will soon be coded to forward visitors to the appropriate page on the new website. However, the original pages will not be removed from this website as thanks to the assistance of our anonymous online marketer, they are all drawing a lot of attention from Google and the other search engines. Finally, all of the related videos on YouTube will be updated to link to the appropriate pages on the new website. We have simplified many of the page names on the new website, and the month by month drop down filing system menu remains fully functional.

The new website, although not yet completed, is fully functional, and the content should be finished by the first week of January 2024.

Throughout the past eighteen months, the brokers at Verico the Mortgage Station have attempted unsuccessfully to hide from their crimes and our requests for an interview. We even offered to cancel the documentary and remove all posts if they could prove to us through an on-camera interview that we were mistaken in our allegations. They wouldn't even meet for a without prejudice meeting, at which time they could have contested our evidence. Instead, they chose to ignore us and to wallow in denial.

That is their collective choice, but the adults want to move forward, and hiding is no way to counter our allegations of serious criminal offences.

Last week, somebody sent to our producer what they claimed was a legal order to cease and desist publishing this story. However, they did so anonymously, through a generic email address, and without showing sufficient courage to even identify the sender. That act of outright cowardice fails to tick essentially any of the boxes regarding the rules of service that are dictated by the Rules of Civil Procedure for the Superior Court of Justice. So, we are showing it and the craven writer all the courtesy they have shown themselves to deserve.

Our reporting will continue to be updated unabated.

The recently received, and legally irrelevant, “Libel and Slander Notice” that was sent to our producer anonymously via a generic email address earlier this week contains a lot of huff, puff, and bluff, but what it does not present is any apparent understanding on the part of the writer as to why we are producing this documentary. What it did show is that the writer clearly does not understand that they are not the victim, and that it is they who took action by loan sharking to start this story, and then fueled the fire by trying to cover up their actions for selfish reasons.

It is the brokers at Verico the Mortgage Station who broke various laws, yet they persist in painting themselves as good people who helped our producer through loan sharking, and then covering it up.

In their anonymous ‘notice’, the writer, who was too cowardly or ashamed to affix their name, stated: “The one-sided feud you have created isn’t in the interest of the public but your own self-interest of presenting yourself as a victim in order to create career opportunity for yourself.”

The cowardly anonymous writer of this whiney 'notice' seems determined to paint themself as a benefactor to their victim of usury, or loan sharking, rather than facing the fact that the brokers are the ones who breached professional ethics and broke the law.

Apparently, they do not understand that it is very much in the public interest for us to report the facts and present the evidence of how a business that is licensed based on trust has abused that confidence by ripping off senior and veteran clientele through loan sharking and then covering it up. That feigned ignorance, however, is all a ruse, as if they had done nothing wrong the brokers at Verico the Mortgage Station would have stood up long ago to disprove our allegations during an interview or in a court of law instead of hiding for 18 months, and now trying, vainly, to scare us off through a threatened Strategic Litigation Against Public Participation (SLAPP) lawsuit.

The epidemy of this need to conceal is shown by how the ‘notice’ is unsigned and was deliberately sent anonymously through a generic email address.

Anybody who knows our producer will tell you this is not about his career. He has been an international journalist working in regions like Bosnia Herzegovina during their civil war and the Middle East during the first Gulf War. He has also been the Deputy Editor of a national European newspaper that was owned by the Washington Times. Now, he runs a fourteen-year-old production company that is successful and respected, a very much appreciated nine-year-old community channel, and he owns professional level studios and facilities that are unrivalled by any private production service north of Toronto. At 58 years of age, he is not interested in starting somewhere new.

To understand who we are, the reader needs to go no further than the first line of our website’s home page which contains the following statement.

“The OCANetwork, also known as Five Points Media, is a community-oriented and locally focused broadcast-quality on-line media service that offers support and a nonjudgmental voice to those who are all too often ignored by mainstream media. This policy extends to all benevolent groups and agencies that support equality. We reserve the right to analyze and expose political groups and organizations that promote hatred and racism, as well as anybody who takes action that can hurt others.”

“We reserve the right to analyze and expose . . . anybody who takes action that can hurt others.”

We have posted other stories through which we exposed the crimes and abuses of others, ranging from a slum lord who contributed to the death of a disabled man, a rental scam that defrauded dozens of single mothers, a Toronto private investigations company that defrauded hundreds of employees, and a local business owner who thought that he had the right to abuse and bully other businesses through threats from his self-identified Mensa member lawyer.

In each case, the perpetrator was forced to withdraw, to lick their wounds, sometimes after being defeated in court, and sometimes choosing the path that did not expose them to that kind of public humiliation.

The writer also asks, “If you are unwilling to look past your own personal vendetta, then at least consider those who have helped you – do they really need to answer for their actions in court?” What the writer does not seem to understand is that loan sharks do not help people, but victimize them, which it is why the practice is ILLEGAL. It is also why it is an indictable offence punishable by a prison term of up to five years. Also, covering for that crime after the fact is a crime, as is ‘motivating’ police officers to omit the evidence to dodge charges. All of those crimes are punishable by time in prison, up to 14 years, and the Superior Court Justice will know that.

Also, nobody but the business owner benefits when they defy and evade ‘regulatory requirements’ to conceal the crimes committed by the loan sharks.

The writer feigns innocence by claiming the interest taken was ‘only’ $200.00, when it was in truth $450.00, but fails to mention that despite the exposure and whitewashed police investigations, they still have not returned more than half of what they stole. Apparently, they thought that the ‘favour’ done for them by the South Simcoe Police Service would be enough to dodge accountability. Now both they and the open to options detective face scrutiny from Office of the Independent Police Review Director that will likely be undertaken by the Ontario Provincial Police Financial Crimes Division.

Their actions after being advised about the usury are not indicative of any kind of ‘administrative error’, which would have been corrected, but are a clear-cut example of an attitude of privilege granted by wealth.

Renee Dadswell did begrudgingly return the $200.00 ‘administrative fee’ eventually, a month or more after stealing it, but only in response to our producer warning of pending litigation and a complaint to the Financial Services Regulatory Authority of Ontario (FSRA) if she did not do so. In her email of June 14th, 2022, Renee Dadswell acknowledged this by writing: “In reviewing the document, you are correct in stating that since the term stated was very short, that the amount of the administration fee would exceed the limit of an allowable cost of borrowing. As a result, I have sent an email money transfer of $200.00 to your bank account, (automatic deposit) which is the administration fee that was originally charged.”

Remember that these ‘professional’ brokers deal with loans and interest rates every day, so the Superior Court Justice is not likely to put much stock in any claims of ignorance or innocence.

With regards to the writer’s question of “do they really need to answer for their actions in court?”, the answer is a resounding YES! Why else would we want this matter to go to court if not to present our evidence of the crimes committed by the brokers at Verico the Mortgage Station where they will be compelled to testify so we can question each of them under oath at the risk of them being charged with perjury if they lie, as we have shown they have done in every other form of communications? They have lied verbally, and in emails, and by omission, and by avoidance of 'regulatory requirements', and they have ignored our multiple requests for an interview through which they could disprove our allegations and debunk our evidence if they have anything with which to counter either. The trial, which will happen in about 24 to 36 months, will produce the meat and potatoes of the content of our documentary, and since we know we are telling the truth and that we have the evidence to back it, we welcome their Statement of Claim so we can establish the truth through the most official of forums.

Exposing abusive civil action, and addressing the evidence and actions publicly, is a service to all Canadians, and in this case, especially potentially vulnerable seniors.

Although the discovery phase of a trial is protected, and we will of course fully honour that, all things said in a court of law are open to public scrutiny. There is even somebody in the room recording every word, and anybody can buy a transcript. Also, all documentation goes into a file that can be requested from a clerk and can be photocopied and taken out of the court office. All documents are filed, including affidavits, notices of motion, factums, and evidence, that are filed as part of the publicly accessible record.

Was that a Freudian slip when the writer noted “for their actions”?

Not only will we be sure to summons David Flude, Lisa Purchase, and Renee Dadswell, but we will also be serving summons on those we advised eighteen months ago about the crime of usury, or loan sharking, but who chose to do nothing even after receiving non-redacted copies of the evidence. Their decisions to put money before protecting the potentially vulnerable senior clients will then be part of the public record, for all to see, and for competitors to use against them.

- W. Mark Squire, President and Chief Operating Officer, Verico Financial Group

- Steven Ranson, President and CEO of HomeEquity Bank

- Yvonne Ziomecki – Fisher, Executive Vice President, Marketing and Sales at HomeEquity Bank

- Akash Durbha, Director, Contact Centre and Client Relations, HomeEquity Bank

- Chief John Van Dyke and Inspector Julio Fernandes of the South Simcoe Police Service

- Detective Jason Muto of the South Simcoe Police Service, regarding his omission of evidence and use of falsified figures.

By that time, a legitimate investigation will have been completed by the Office of the Independent Police Review Director, most likely through detectives of the Ontario Provincial Police Financial Crimes Division.

In addition, we will likely summon the CEO or head of mortgages for a couple of the larger lenders on the list of financiers posted by Verico the Mortgage Station. We will also call on testimony by Mark E. White, Chief Executive Officer of the Financial Services Regulatory Authority of Ontario (FSRA), who as an expert in the field, can tell the court directly if it is normal for brokers to charge a client almost 200% interest on a short term loan, when the legal limit in extreme situations is 60%, and then refuse to meet in violation of ‘regulatory requirements’, to lie six times in two emails to evade that responsibility, and to then threaten Strategic Litigation Against Public Participation (SLAPP) lawsuit to scare off legitimate exposure. We will also be calling on several of the people who have come to us with stories about similar abuses by the brokers at Verico the Mortgage Station, and quite a few members of the Simcoe County charitable and benevolent organizations that we have helped during the past nine years through the donation of 350+ videos to 180+ charities, not-for-profit organizations, and benevolent community groups, valued at more than $700,000.00.

What the writer of this ‘notice’ does not seem to understand is that the discovery phase of the litigation involves FULL exposure, including financial and communications, which is undertaken under court order.

It is not our preference to defend against these allegations of libel that are so frivolous the complainant would not even affix his or her name to the allegations. It is also not the first time some self-absorbed ‘superior’ person has 'threatened' to abuse the purpose and intent of the civil court system in a vain attempt to stop us reporting on their wrongdoing through Strategic Litigation Against Public Participation (SLAPP) litigation. Each time those claims, that were no different and had no more merit than the one threatened now, failed publicly and the claimant was not only humiliated but also financially ruined. This was not due to our action, but because our producer successfully defended against actions taken for the pupose of censorship.

As the old sayings go, “Don’t throw if you can’t catch,” and “Never bring a knife to a gun fight.”

In a Daily Update report, dated December 28, 2023, we noted that our producer had received via email a supposed “Libel and Slander Notice” in the form of a PDF that was sent through a generic email address and was not signed. In fact, the writer proved to lack the courage required to even assign his or her name. So, we have no idea if this ‘threat’ of civil action is real, or if the sender has the authority to speak for the brokers at Verico the Mortgage Station.

What we could not miss is that the supposed legal document, purportedly sent by a corporation, was not written or served by a lawyer who is licensed by the Law Society of Upper Canada.

Five Points Media is a small not-for-profit community channel that donates all services to charities, not-for-profit organizations, and benevolent community groups. It is also a well-established reality that our producer has challenged abuses of the power of the legal system, both civil and criminal, and he has won every time. So, it comes as a surprise to nobody that he is able to present his own case in a court of law.

A civil action of this nature, when one party is clearly abusing the true intent of the court, draws followers like flies to an ice cream cone, which is exactly the kind of case no ethical lawyer would want to accept.

In those cases, the abusive business owners lost everything, as the truth of their oppressive actions scared away their clients, leaving them bankrupt, and in one case, homeless.

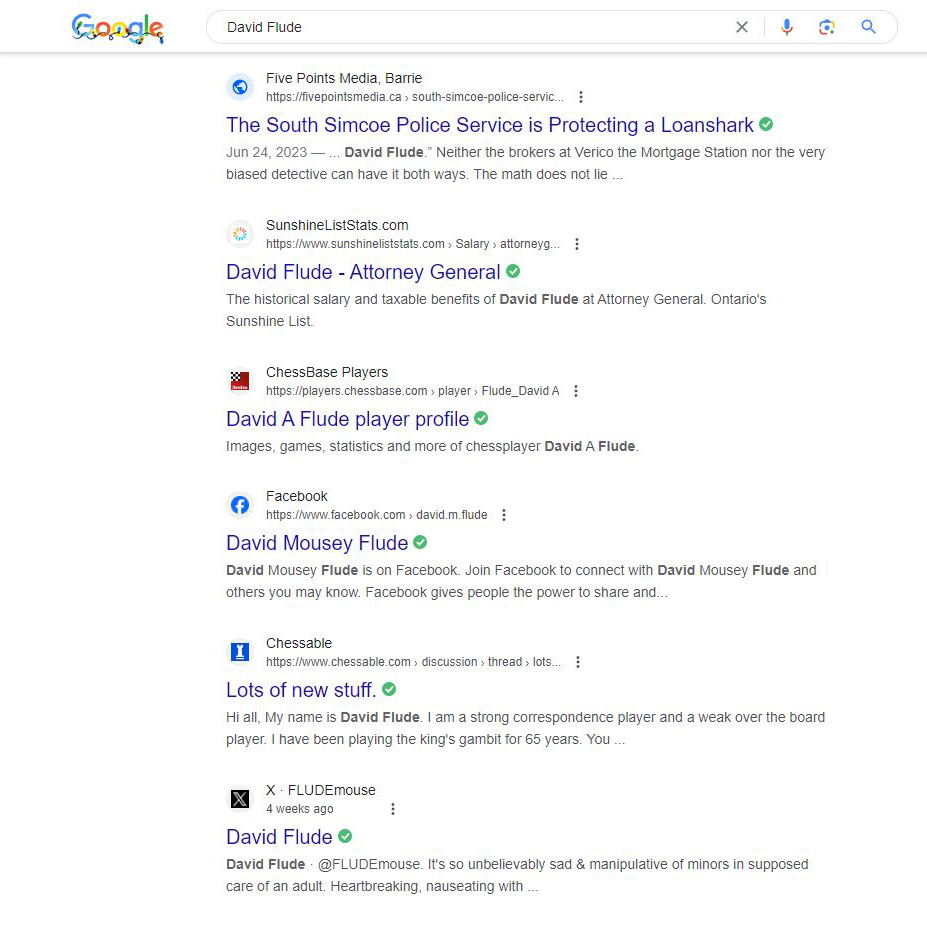

According to research we have conducted, and this might need upgrading, David Flude is the only owner and director of Verico the Mortgage Station. If this is incorrect, we welcome him to advise us and we will correct the error. If that is true, and if the court grants consent with the approval of the opposing party, only he can act as a self-represented litigant in the case.

The Rules of Civil Procedure are clear in that a litigant can retain council or self-represent, but they cannot be represented by somebody who is not licensed by the Law Society of Upper Canada.

The issue with that will become clear when we post the ‘notice’ and our reply during the first week of the new year. Given David Flude’s proven propensity for deception, we also sent that reply to David Flude, Lisa Purchase, Renee Dadswell, the board of directors at HomeEquity Bank , the management team of Verico Financial Group Inc., and all the known lenders who provide funding mortgages arranged through the brokers at Verico the Mortgage Station.

The ‘notice’ was written badly, legally speaking, and it was so full of bitterness, emotion, and leaps of logic that it would elicit a cringe from any person who has actually argued before a Justice of the Superior Court.

It was also quite obviously not proofread by anybody with a better than average command of the English language, which would suggest it was not forwarded first to either of their aiders and abettors at Verico Financial Group Inc. or HomeEquity Bank, whose reputations are riding shotgun to the abuse of trust undertaken by the brokers at Verico the Mortgage Station. Those companies have a significant stake in this matter going to court, as when the brokers at Verico the Mortgage Station fail to present their case in a cohesive manner, they will all be humiliated by the exposure of the truth due to inexperience and incompetence.

Why would these multi-million and multi-billion-dollar corporations even entertain the idea of self-representation in the Superior Court of Justice?

One possibility is that they can’t find a lawyer who will take this case. That is speculation, but if you look at the evidence it is a worthy theory.

- Lawyers like to take cases they believe they can win as their reputation for winning is what gets them other cases and higher hourly rates.

- No lawyer wants to lose to a nobody, and that is especially true when they know the loss will be made public.

- Our producer has an established history of defeating lawyers in the Superior Court whenever the action is abusive and the evidence disproves the lies.

- During the Mustang case, a rising star lawyer named Norman Groot was unceremoniously ripped from his position at the prestigious Bay St. law firm of McCague Peacock Borlack McInnis and Lloyd Llp because of his failure to force our producer to surrender to the company's demand for silence.

- Groot tried and failed to convince a Justice of the Superior Court that the court should order our producer not to report on the abusive civil action through his private website, but the motion failed as all citizens have the right to Freedom of Speech and Freedom of the Press under the Charter of Rights and Freedoms.

- What chance do the brokers at Verico the Mortgage Station have of attaining that kind of injunctive relief against a nine-year established community media company that has donated $700,000.00 worth of services to more than 180 local charities, not-for-profits, and benevolent community groups, and was voted to the highest levels for an award for altruism in 2020?

- A total of seven other lawyers resigned or were fired from the Mustang case, and some where stripped of their positions at lofty law firms because of the ongoing exposure of their failures.

- Mustang Investigations advised the court that they had spent $400,000.00 in legal fees and lost $500,000.00 in income due to the ongoing exposure of their abuse of civil court, and they were ordered to pay $20,000.00+ in costs to our producer when they abandoned their claim and allegations.

- A short time later, Mustang Investigations went out of business and the owners lost everything they had worked to build for more than eight years.

- In the Barrie case, the abusers went broke, the politician fled Barrie to avoid a metaphoric tar and feathering, and the once respected detective was reduced to uniformed service in the evidence room.

- A civil action of this nature, when one party is clearly abusing the true intent of the court, draws followers like flies to an ice cream cone, which is exactly the kind of case no ethical lawyer would want to accept.

- Within the unprofessional and anonymous ‘notice’ the writer admits to many of the allegations, buffering reality with excuses, self-deluding rhetoric, and an embarrassing level of whining.

For several weeks, right up until Christmas Eve, our website was visited just about every day by people hiding behind proxy servers who were very specific in what they viewed.

Some viewed a few of our fully-donated community stories, but mostly they went directly to the story about the slumlord whose greed contributed to the death of a disabled man, or to the story about how we came to the aid of a group of single mothers who had been cheated in a rental scam, and finally to the story of how a local bully business and their Mensa member lawyer ran away with their tails between their legs after we responded to their threats of Strategic Litigation Against Public Participation, or SLAPP lawsuit.

As was the case in two of those stories, the new visitors simply went no further as they had evidently seen enough to know this was a no-win scenario.

Within the purported ‘notice’, the writer spends a lot of time whining and complaining, and they seemed to fixate on one comment made by the Justice when our producer was successful in finding a local civil court abuser to be a vexatious litigant. They also tried to justify loan sharking by claiming it was an ‘administrative error’. For that to fly, the Justice would have to be ‘motivated’ as was the detective of the South Simcoe Police Service, to completely ignore the dozens of times the accusations have been published, and the fact that only part of the money stolen by usury has ever been begrudgingly returned.

That is a convenient accounting of ‘alternative facts’ that crumbles due to its own rot even if it is unchallenged by real evidence or with any level of intelligence or logic.

Another thing to keep in mind is that the case of Mustang Investigations became very well known within legal circles, as it was the very first time in Canada that an obvious abusive of our legal system was exposed by an experienced journalist through the Internet for all to see. At the time, we were told, law school professors were referring to it in lectures, and Justice Perrel of the Superior Court in Toronto referred to our reporting as ‘the Internet Blood War’. It is likely that any seasoned lawyer would remember something of the case or that they would remember when looking up our producer on Canlii.

That online story drew 400,000 visitors to our website, mostly professionals from insurance companies that hired private investigators and lawyers who had an interest in the case.

The public nature of the reports forced Justices to be fair, and to make ruling based solely on established law. In one instance, a Justice recused himself from ever hearing motions on the case again after advising the lawyer, in front of our producer and his family, “Do not come back to me for anymore favours.” That case resulted in nine lawyers from three Bay St. law firms being chewed up and spat out as one after another failed through a variety of tactics to intimidate or attain capitulation from their intended victim.

Are the management teams of the Verico Financial Group Inc. and HomeEquity Bank really going to allow their reputations to be decided by a brokerage whose owner is so clearly out of his depth?

We have all watched that movie in which the sleazy character gets their comeuppance after running away to escape the monsters, leaving others to die. The corporate guy from Aliens come to mind, and who can forget the cowardly lawyer in Jurassic Park who was eaten by a T-Rex while hiding in a toilet after abandoning the children to their grizzly fate? It now appears that is where we are in this story.

Yesterday, our producer received via email a self-written and anonymous PDF document claiming to be a “Libel and Slander Notice”. Unfortunately, due to an obvious lack of experience and awareness, the purported 'legal document' fails to check virtually any of the boxes required by the Rules of Civil Procedure that govern conduct in the Superior Court of Justice in Ontario. Based on the frail and frankly pathetic nature of what we received, it seems that the brokers at Verico the Mortgage Station, after hiding for more than 550 days, are now backed to a wall and scratching at the air like a declawed kitten challenging a rottweiler.

The ‘notice’ reads like the sniffling of a small child who has been forced out into the light of scrutiny after eighteen months of hiding in the dark, and is now trapped in an alley trying to evade the monsters of truth and evidence.

We have chosen to wait until after the new year to post the notice and our response and to analyse the content through an article. The main reasons are that we are currently putting the final touches on our new website at www.themortgagestation.tv and this week is quiet for traffic due to the holidays. We are also working on a new video through which we will present all the evidence through a synopsis of this story.

. . . now trapped in an alley trying to evade the monsters of truth and evidence

Sufficed to say, the package demonstrated a complete lack of knowledge of the law, no indication of who sent it, no notification of the counsel of record, and nothing more than a combination of threats and sniffling.

For investigative journalists and producers of socially poignant documentaries, ‘legal’ threats are as common as cream cheese on a bagel, and they are usually not worth the neurons used to send them via email. Most of our readers remember the story of the slumlord who contributed to the death of a disabled man, whose big-bad lawyer disappeared immediately after our producer responded to a whole slew of vacuous threats. Then of course there was the issue of Tyger Shark, whose lawyer, a self-identified member of Mensa, turned tail and ran when he received our response to threats pertaining to a five-year-old video the owner demanded we remove from our website at our expense for no reason other than he thought he could be a bully.

In this sad and pathetic adventure, the wannabe tough guy/girl didn't even hire a lawyer to write the letter.

Apparently, the writer believes that the law, like those pertaining to usury or loan sharking, and the “Rules of Civil Procedure” that are compulsory in the Civil Courts, do not apply to them, and their feelings are what really matter. They felt that their breaking of Section 347 of the Criminal Code of Canada was acceptable because they wanted to be exonerated, and then they went on in their Trumpian way to explain that they are the victims and that it did not matter that they broke the law, took advantage of their client(s), and violated the ‘regulatory requirements’ of their profession that are intended to protect clients from just this kind of abuse of trust.

This sudden change of heart, which came about after 18 months of hiding, is likely the result of our decision on December 12, 2023, to write to the lenders who provide mortgage funding to Verico the Mortgage Station.

That is speculative, but it is also very well timed. Our story includes the names of each bank and lender, and pursuant to the fair dealing exemption in the Copyright Act, we included some of their logos. It seems unlikely that any of those legitimate businesses want anything to do with loan sharks who abuse the trust of seniors, and we feel it is likely that they set a deadline for David Flude and other management at Verico the Mortgage Station to clean up their house.

Quite honestly, if this cowardly anonymous ‘notice’ is the best they can do, they need to sit down with a good lawyer, but he or she is likely to tell them facts they just don't want to hear.

Of course, the demand of the notice was for us to remove all our reports and videos, to apologize and to post a retraction. That will be a cold day in hell. The only reference to their crimes were sniffling claims of no harm done and that the law for some reason did not apply to them. There was no suggestion that the brokers at Verico the Mortgage Station would publicly accept responsibility for their crimes, or that they would in any way offer anything in return for our full capitulation to their demands. Keep in mind, that this ‘big and bad threat’ was being sent to us by some anonymous wannabe, who did so without the assistance of a lawyer, and they were claiming the law and rules of litigation do not apply to them.

Even Donald Trump, a full-blown narcissist, had enough sense to hire lawyers to try to make the truth and evidence of his crimes just go away, and we all know how well that has worked and how much it has cost him.

How do you take somebody like this seriously? It is like that child in the picture, trapping themselves in the alley with the monsters of truth and evidence, vainly shaking their fist at what they are too terrified to face, while trying to look like something they are not and will never be. The writer also tried to claim that by manipulating the timeline of the mortgage, so their mark had little choice but to accept loan shark interest rates of 198.25%, the brokers at Verico the Mortgage Station had somehow done our producer a favour.

That is like saying the dealer made you feel good by getting you hooked on heroin, or the mugger was thinking of you when he relieved you of the uncomfortable bulge of the wallet in your pocket.

The response of our producer’s reply, that was carbon copied to all the representatives of the banks and other financial institutions, was an immediate flood of hundreds of visits to various pages on our website, with special interest being shown to the pages he had linked to regarding the court cases noted above. It seems evident that these financial professionals understand that the brokers at Verico the Mortgage Station waited too long to address the elephant in the room, and they have shown cowardice by hiding because they know they are guilty. As a result of their own actions, or lack of, they had better bring up their A-game FAST. Otherwise, the brokers at Verico the Mortgage Station will likely be abandoned to the pain and suffering of their own less than ethical behaviour.

Threats don’t work here, so if the brokers of Verico the Mortgage Station have done nothing wrong, they can take the opportunity to rebuke our evidence with their own through a video recorded interview.

As promised, we are using the quiet period of the holiday season to create a standalone website for this documentary through which we will be exploring loan sharking at Verico the Mortgage Station, the reason behind whatever ‘motivated’ the South Simcoe Police Service to omit evidence of an indictable offence, and other stories of abuse within the mortgage brokerage industry. The website will be fully rooted at its final address by January 1, 2024, but for now, you can see it updating in real-time at:

The holding page on the domain at https://www.themortgagestation.tv/ has already been visited more than 700 times since we first reported on it not so long ago, and it was nothing more than a redirection page that sent visitors back to the established articles on the Five Points Media website. Clearly our new promotional ally has already boosted that domain, as it can already be found by Google and other search engines. When fully coded for search engine optimization, it will not be limited regarding promotion by the confines of our community channel.

As per the request of our followers, the home page will feature a synopsis of the story so far, and a video outlining the highs and lows of dealing with the loan sharks of Lefroy, and their enabling assistants at Verico Financial Group Inc. and HomeEquity Bank.

Through our research regarding Search Engine Optimization, we learned that maintaining and frequently updating a subject-relevant blog is one of the best ways to attract the ‘robots’ and ‘spiders’ of the search engines, which improves your website’s footprint on the Internet.

So, we thought we would kill two birds with one stone.

Our new Daily Updates page includes short stories and pertinent facts that are better suited to short posts rather than full reports or articles. It will be updated more frequently than adding new pages and will be organized with the most recent updates at the top.

During the past week, we have been thoroughly researched by an easily identified very interested follower. Not only did they visit at least forty pages of our website (we only have 32 pages dedicated to this story) but also, from what we can tell, they watched every video we have produced about the mortgage brokers at Verico the Mortgage Station, who run a side-gig of defrauding their senior and veteran clientele through loan sharking, lies, and manipulation.

We are very confident in saying we know the identity of this specific visitor, but to identify them would be at best an educated guess based on available data and some pretty advanced technology.

It does not require a lot of thought to understand why the management teams of the Verico Financial Group and HomeEquity Bank are now becoming very concerned regarding a story they thought they could simply ignore until it went away. We say that mostly because the forty-plus visits happened during the dead of the night, with a few pages visited at two something AM, then an hour later a few more, and the pattern continued throughout the night as if the researcher was burdened with insomnia due to a heightened level of concern about our fully factual and evidence-supported reports and videos.

It is also not a coincidence that this all happened immediately after we posted a report discussing how we had reached out to every lender that works with the brokers at Verico the Mortgage Station.

Those bankers are not likely to have much of a sense of humour about being named in reports about a mortgage brokerage in Simcoe County that cheats seniors through usury, or loan sharking, and then lied at a pathological level to evade being reviewed by the Financial Services Regulatory Authority of Ontario (FSRA). However, these lenders are part of the story, as those who borrow from them have a right to know the truth about with whom they choose to do business.

Also, by advising them of the facts, those provincially regulated financial institutions cannot feign plausible deniability when this story hits the fan through broadcast television and streaming services.

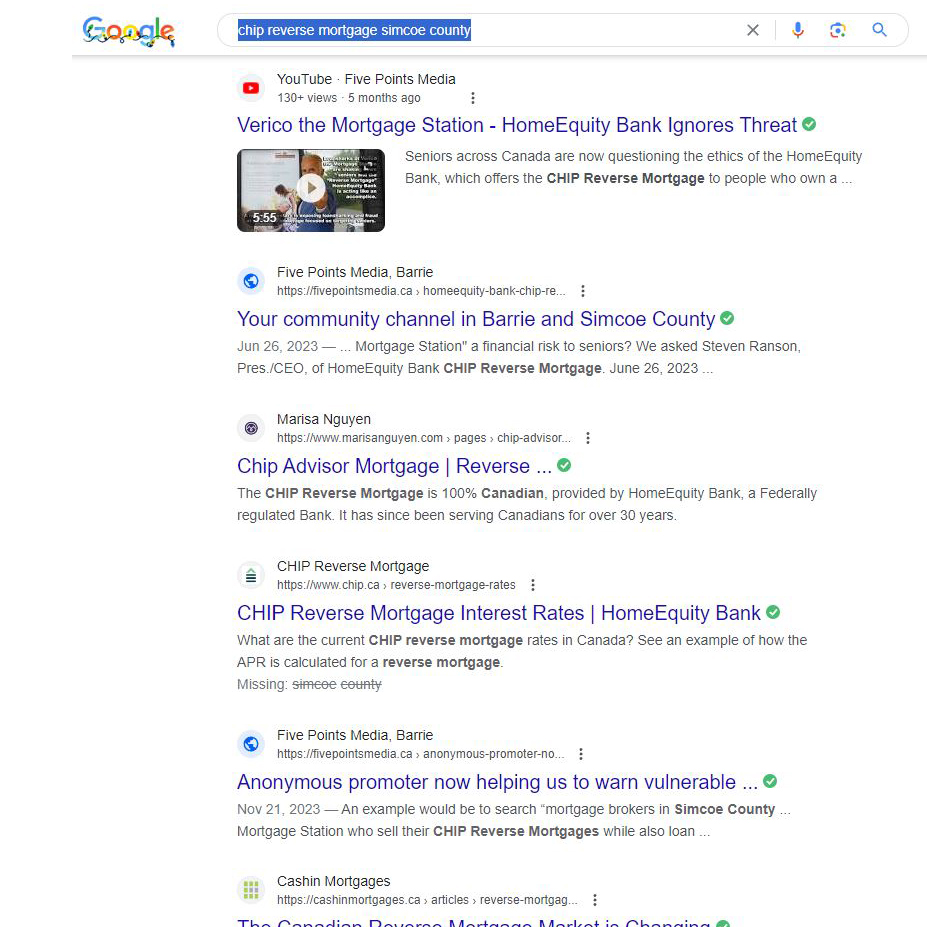

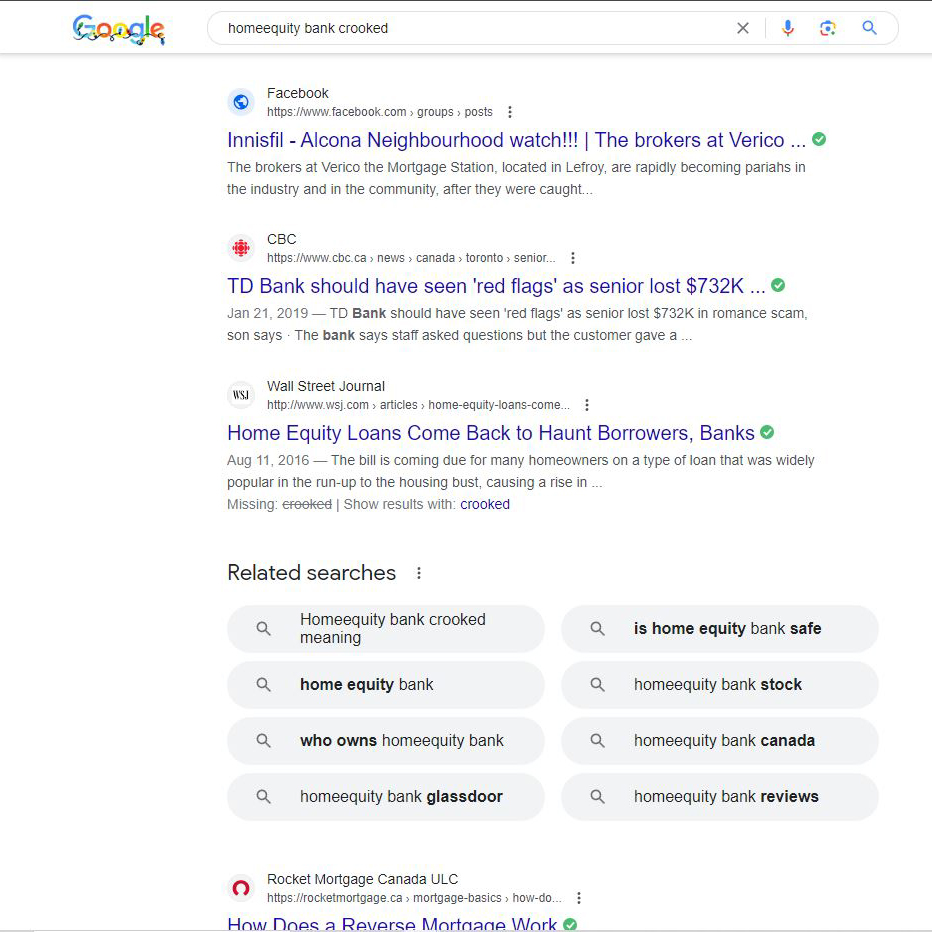

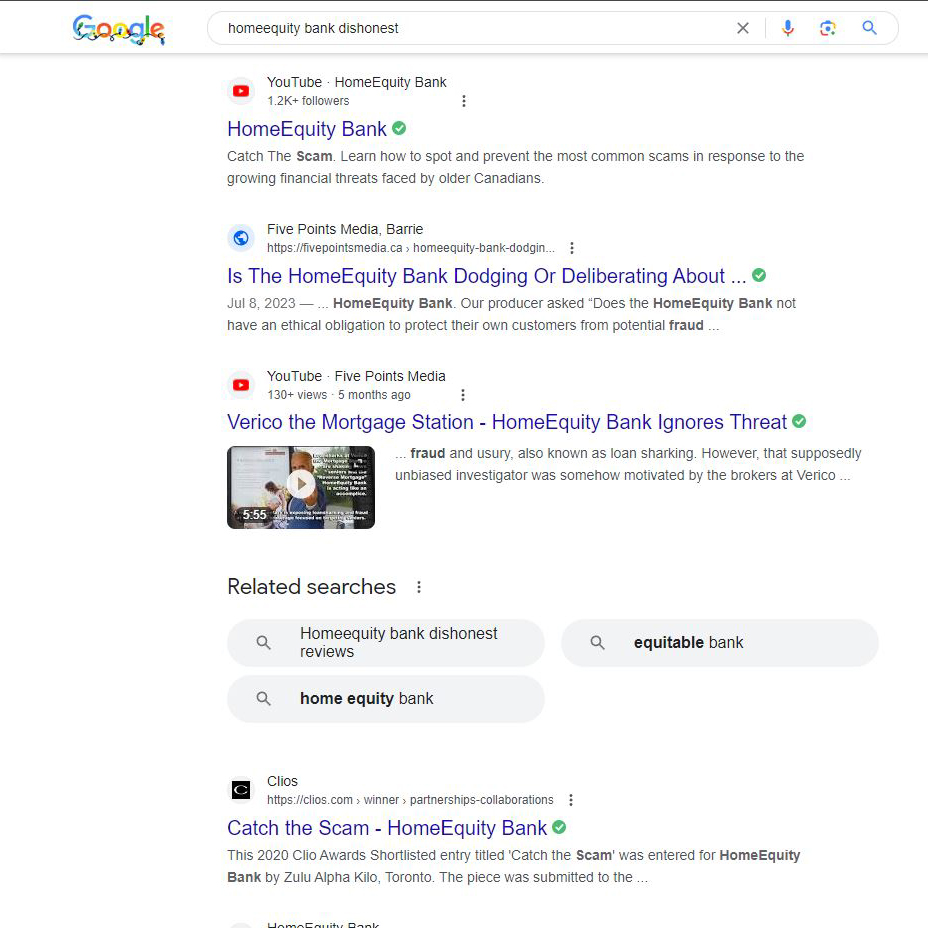

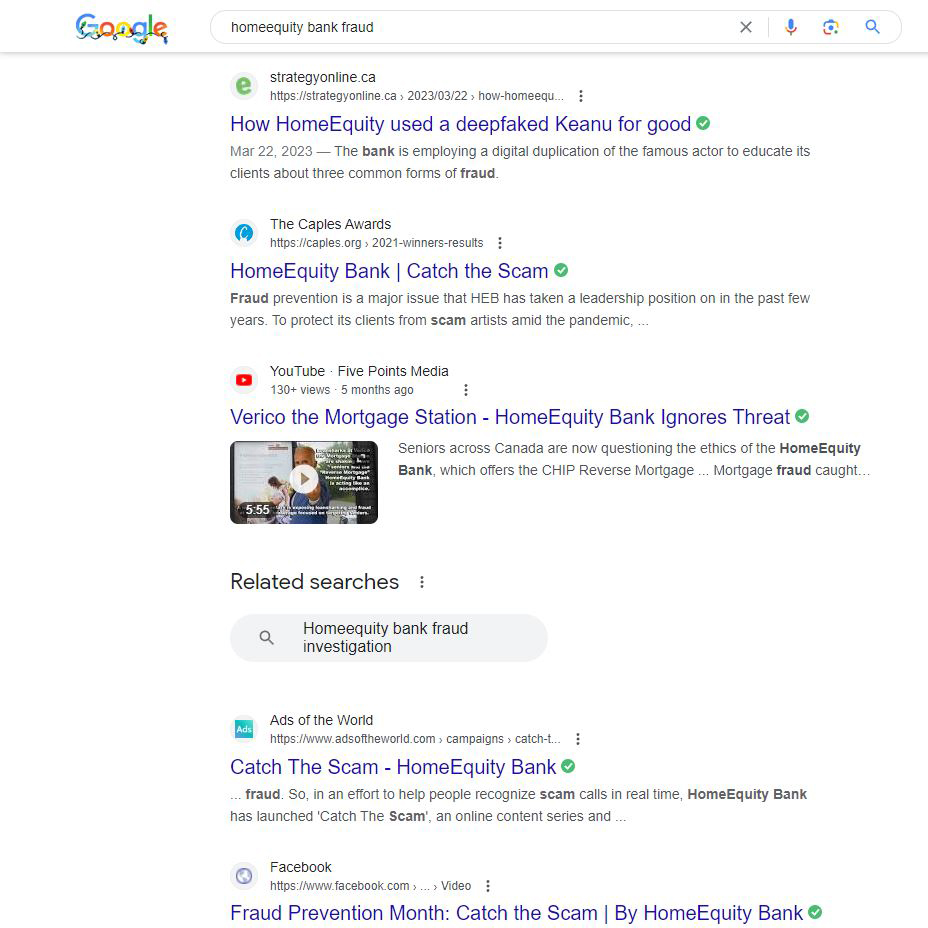

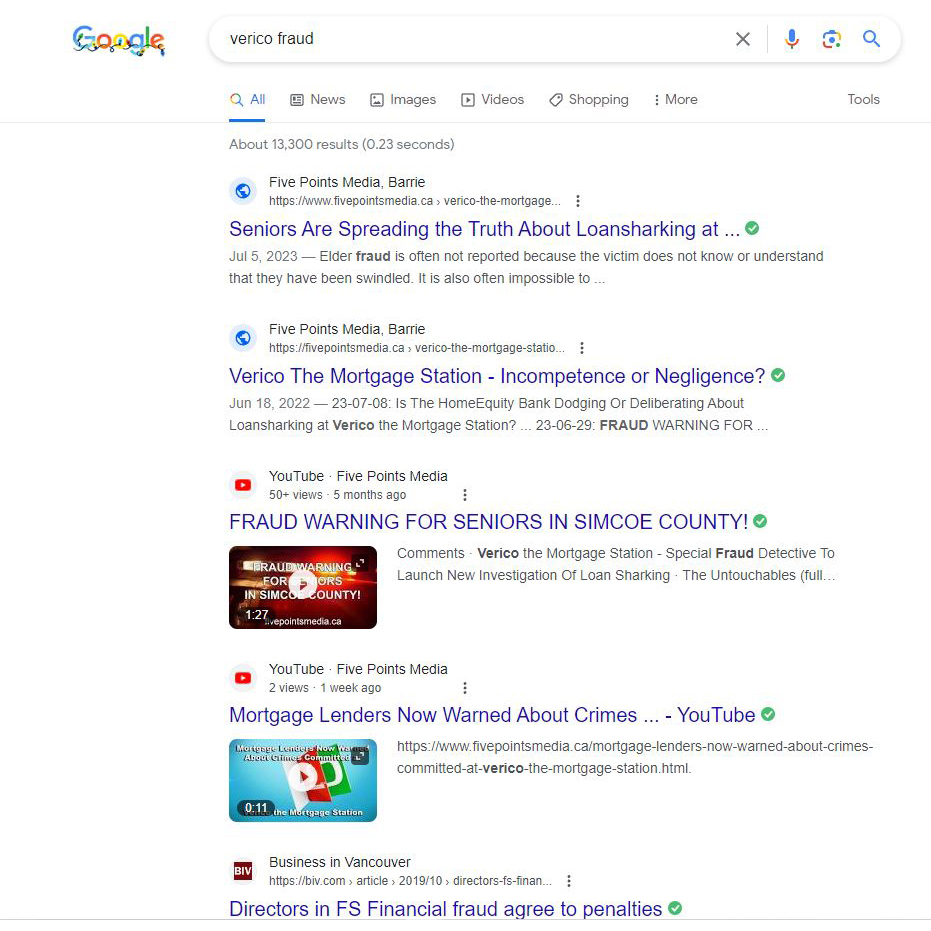

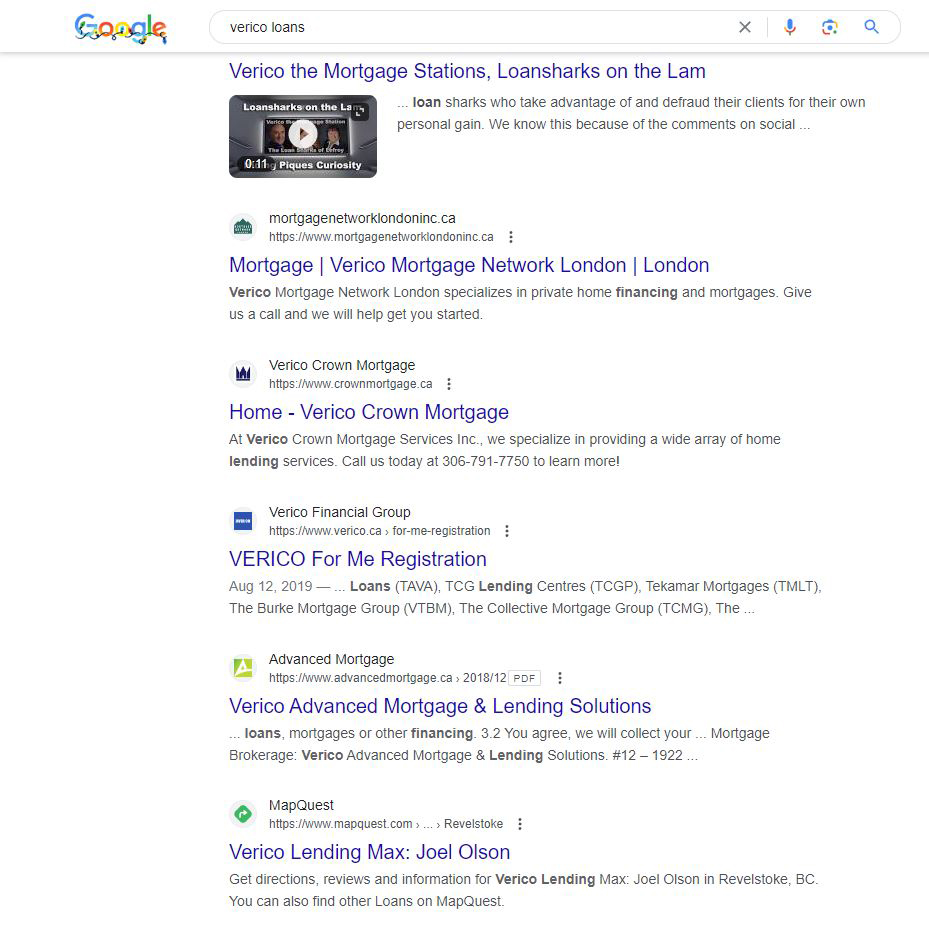

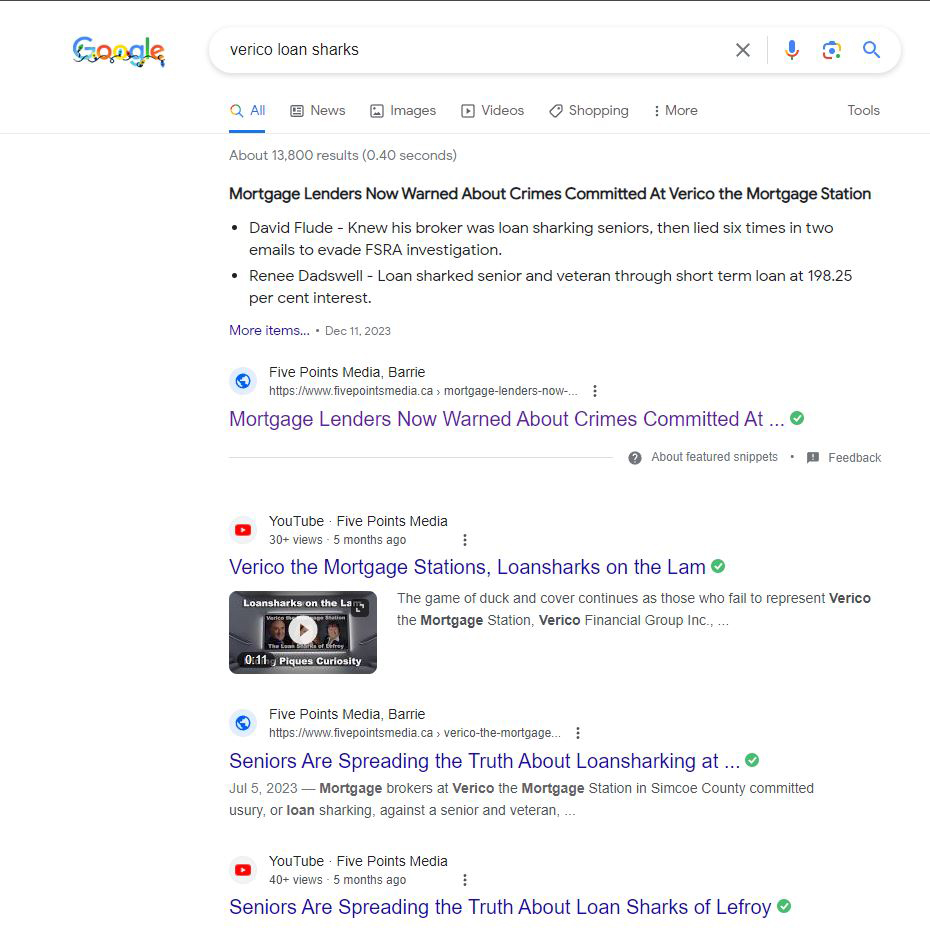

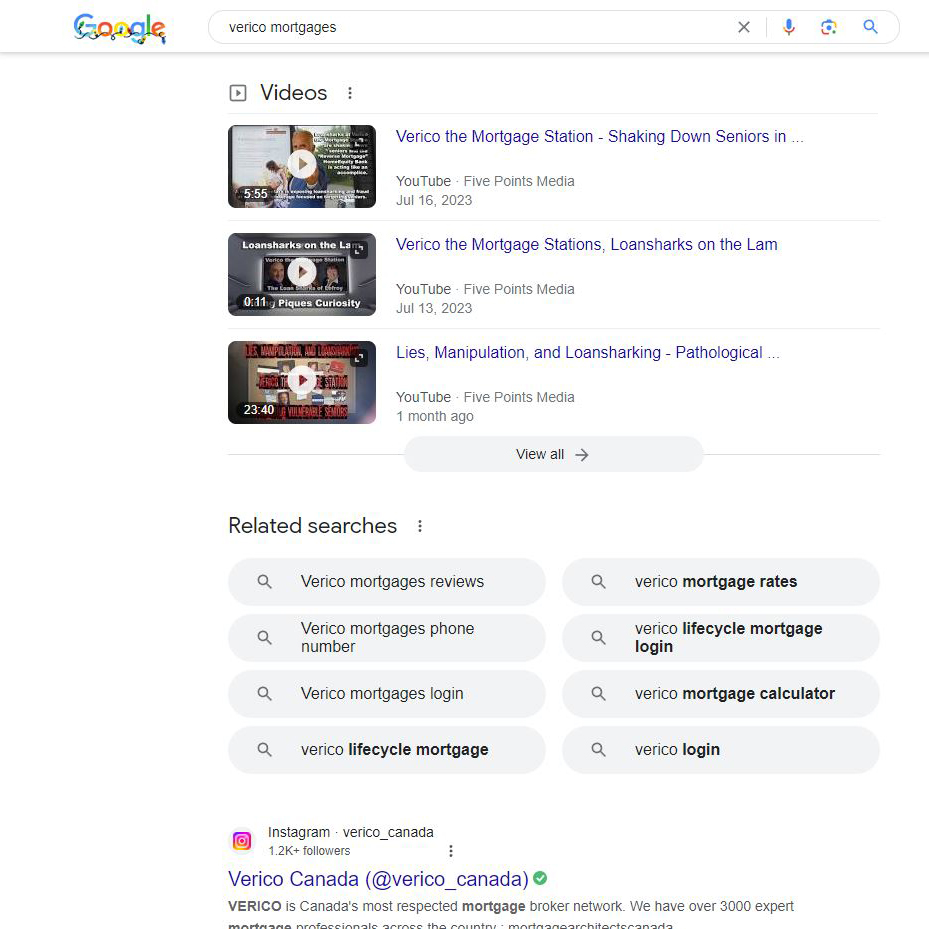

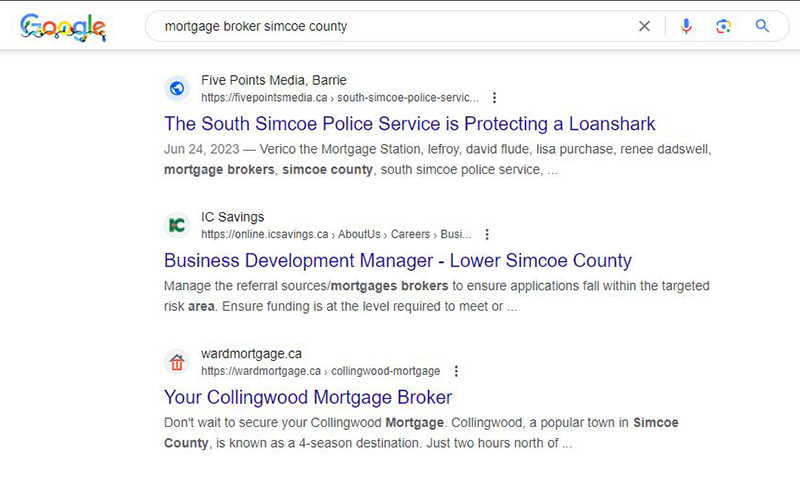

It also likely weighs heavy on their heads that an anonymous, likely self-serving, promoter is boosting our stories and videos on the search engines, and that last week we optimized our content resulting in greatly improved results on Google and others. Now, our stories are coming up consistently on page one of Google and other online sources when referencing just about any combination of words about any of the key players in this story of fraud through loan sharking within a mortgage brokerage in Simcoe County.

It seems these multi-million and multi-billion-dollar corporations would rather be humiliated by a small not-for-profit community channel, rather than demand accountability from their colleagues.

More than eighteen months ago, either Verico Financial Group or HomeEquity Bank could have stopped this story before it started. That was when our producer wrote to them both advising them of the fraud by usury that was being undertaken by the brokers at Verico the Mortgage Station. They have also had front-row seats to watch as David Flude, Lisa Purchase, and Renee Dadswell have hidden from our allegations rather than taking one of the many opportunities to step up and disprove our allegations using evidence on camera.

These bankers are not stupid; they know only the guilty hide from scrutiny.

We timed the update of our new Search Engine Optimization and the creation of the standalone website for this time when most people are running around shopping and visiting relatives and friends rather than researching online. Regardless, we have maintained and improved our standing on the search engines and by the time the holidays are over, our new information will be firmly rooted in Google and other search engines, resulting in our existing pages and the new website drawing greater numbers. Previously, we ranked well when using the keywords associated with the brokers at Verico the Mortgage Station, but now simply using ‘Verico’ or ‘HomeEquity Bank’ brings our reports and videos to page one of virtually every search engine. We have also started changing our style of writing to ensure that our content is more appealing to the 'spiders' and 'robots' that are now reviewing and indexing our written content every day.

For example, twice in this short article, we used the term “mortgage brokerage in Simcoe County” which we learned through split testing is the most used set of words to find a mortgage brokerage in Simcoe County.

We also know that several local brokers from other companies share links to our content and that at least one has shared several of our videos. Meanwhile, we have experienced multiple hits from towns and cities where a broker for Verico Financial Group Inc. is known to operate. We have no doubt that many of the professionals who invested considerable sums in attaining a brokerage license through the Verico Financial Group Inc. are less than impressed when seeing fully factual and evidence-supported allegations of usury, or loan sharking, popping up in searches when potential clients are searching for information on their business.

Most people would trust incorrectly that the Verico Financial Group Inc. or the lender, HomeEquity Bank, would have taken action to protect their potentially vulnerable senior clients.

Instead, the management team of both the Verico Financial Group Inc. and HomeEquity Bank put on blinders and chose to ignore the crimes being committed against potentially vulnerable seniors. Their focus remained solely on the money being made by this small brokerage in Lefroy, Simcoe County, and they apparently failed to consider what the misplaced and undeserved loyalty would do to their brands, and how that narrow vision would bring harm by association to the many other brokers who had also invested in a Verico franchise, or had selected to sell the CHIP Reverse Mortgage for HomeEquity Bank. It is now 553 days later, and even we cannot accurately calculate how many hundreds of thousands of people have visited this story in that time, or viewed our reports and videos through secondary sources, like competing brokers sharing via email or on their social media.

The coming year promises to be an interesting ride for Verico franchises across Canada, as tens of thousands of potential clients learn the truth about the loan shark brokers from Nowhere Ontario who seem so very willing to bring harm to their corporate colleagues just so they can avoid explaining their actions.

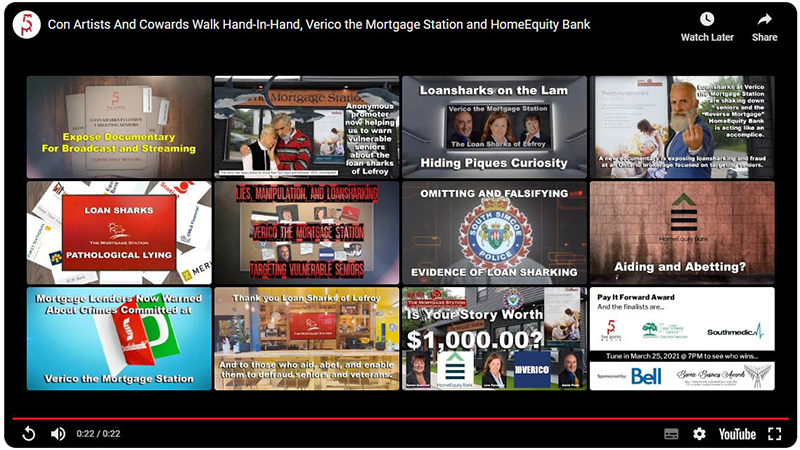

One of our supporters messaged us yesterday to tell us that this is what happens now when you finish watching one of our videos about the crime of usury, also known as loan sharking, that was committed by the brokers at Verico the Mortgage Station. David Flude, Renee Dadswell, and Lisa Purchase may have chosen to hide for eighteen months, rather than stand up to defend their actions on camera, but they are fooling nobody. All they are doing is telling everybody they work with and all of their clients that they know the truth cannot be disproven, which is the only viable reason why they have taken no action to silence us through court action, where if we were lying, they could have secured a restraining order or other injunctive relief to deny us the ability to complete our exposé documentary.

So, now when somebody finds one of our videos, they are immediately given the choice of watching any of more than twenty others on the subject, which are all lined up for them for easy viewing through the click of a finger.

Visitors to our website and those who find us on YouTube are now positively spoilt for choice when it comes to our videos..

The new Search Engine Optimization techniques are definitely working. Some of the changes have been made by us, but the big shift has been implemented by an unidentified promoter who is using Long Tail Keywords to promote our articles and videos directly to the search engine databases.

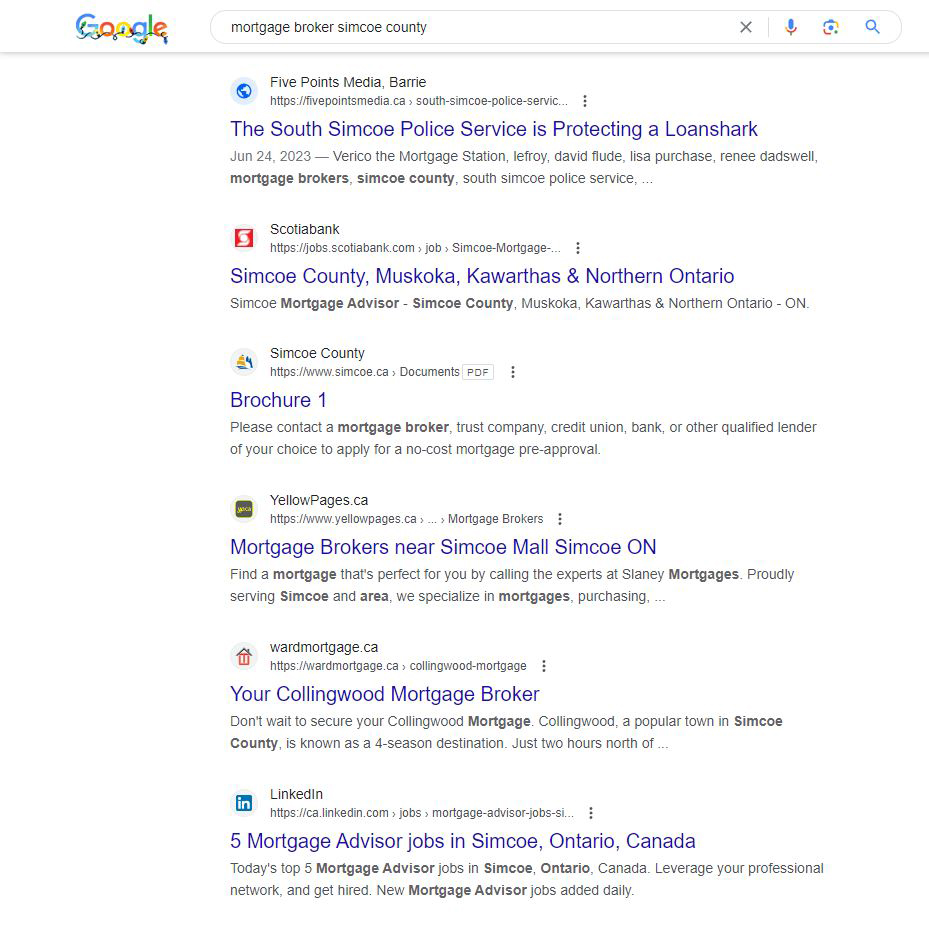

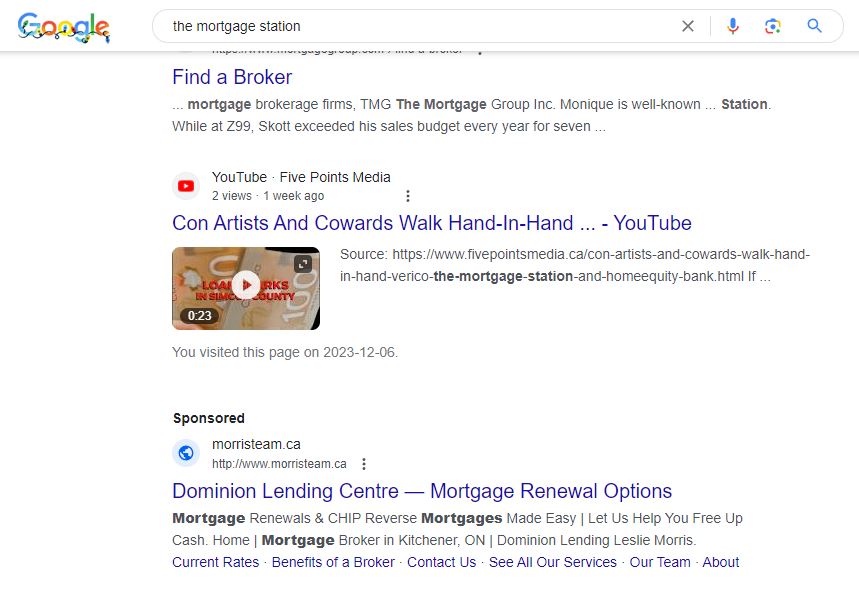

This morning we got a bit of a surprise when we ran a test on Google using the keywords “mortgage broker simcoe county”.

Not only did our story “The South Simcoe Police Service is Protecting a Loan Shark” come up on page one, which had not been the case a week ago, but the link to our story was higher than any reference to the actual Verico the Mortgage Station website or social media.

That means the potential victims of these loan shark brokers will find the truth of our reports and the evidence long before they think of using their services.

Page one of Google, and ahead of any reference to the website and social media of

Verico the Mortgage Station.

As we are a community channel with a long history of helping charities, not-for-profits, and benevolent community groups, we are followed by many people who care about others. One such group is Ryan’s Hope, with whom we have been working the past couple of weeks through a fully donated video that will raise awareness and hopefully some financial support for their great efforts to help those in the greatest need.

These volunteers know all too well what happens when seniors are defrauded, as they are the ones left to help pick up the pieces to assist those whose lives are destroyed due to no fault of their own.

We see them daily, seniors pushing shopping carts and begging for money. They are ashamed, humiliated, and struggling to get through just one more day, yet in most cases, they were not always that way. Most had homes, families, jobs, even careers, but then they were injured, or became sick, and while they were down, they were fleeced by some slicked back con-artist who played outside the rules of acceptable financial services, who ignored ‘regulatory requirements’ that are in place to protect consumers, and who ‘motivated’ people like the police to look the other way and ignore their loansharking or other scams. Well, the good people at Ryan’s Hope learned about our ongoing story through which we are exposing how the brokers at Verico the Mortgage Station defrauded our producer, a senior and veteran, through usury, also known as loan sharking.

Then they started reading our reports and watching our videos.

Now, as can be seen in the lower left of this picture, Ryan’s Hope, a well-known benevolent community organization, is openly supporting our desire to expose the provincially licensed brokers who perpetrated these crimes, but who have never found the courage to defend their actions, nor challenge any of our allegations, and have instead chosen to hide for more than 547 days, or longer than 18 months. This is a bit of a risk for any charity, as like us, they don’t know who is in league with David Flude, Renee Dadswell, and Lisa Purchase, the brokers at Verico the Mortgage Station. They could be risking a source of their limited support, but clearly, they know right from wrong, which is why they are openly letting everybody know, including their followers, that they stand with the potentially vulnerable seniors of their community.

In the purest of ways, they are doing what little they can to prevent the senior customers of Verico the Mortgage Station becoming the next in line at their community breakfasts.

As is true of all grassroots movements, awareness takes time, which for the right cause we are willing to invest. We exposed a Toronto company for defrauding hundreds of employees over an eight-year period, and they threw everything in the book at us to try to scare us off. In the end, after 32 months of us challenging a bogus SLAPP lawsuit, they went broke as exposure scared off all their customers and public awareness brought one government investigation after another, exposing the truth and making it impossible for them to maintain their business that could not function without cheating those who worked for them. Then, we took on a company that had been assisted by a corrupt detective of the Barrie Police Service to try to scare us away from exposing how a local politician had helped them to receive public taxpayer money they did not deserve. That led to a very public 34-month online exposé, resulting in the closure of that business and the demotion of the once respected detective to uniformed evidence duty.

As anybody not wearing blinders can see, we do not ever back off, nor yield to threats, nor do we accept that anybody has the right to silence the truth through intimidation.

The initial reaction to exposé reporting is shock and awe, and then doubt. However, before long, as they start to review the facts and evidence, the public comes to realize that the stories are true. Then actions like the proposed picket line by a local union and open support by charities show the doubters that the stories told by those who are being exposed for crimes and other bad behaviour simply don't stand up to the strength of the evidence presented. Then people start reaching out to other journalists who are also advocates for justice and consumer advocacy but for larger networks.

That is when the customers stop coming, and the community closes down the con artists.

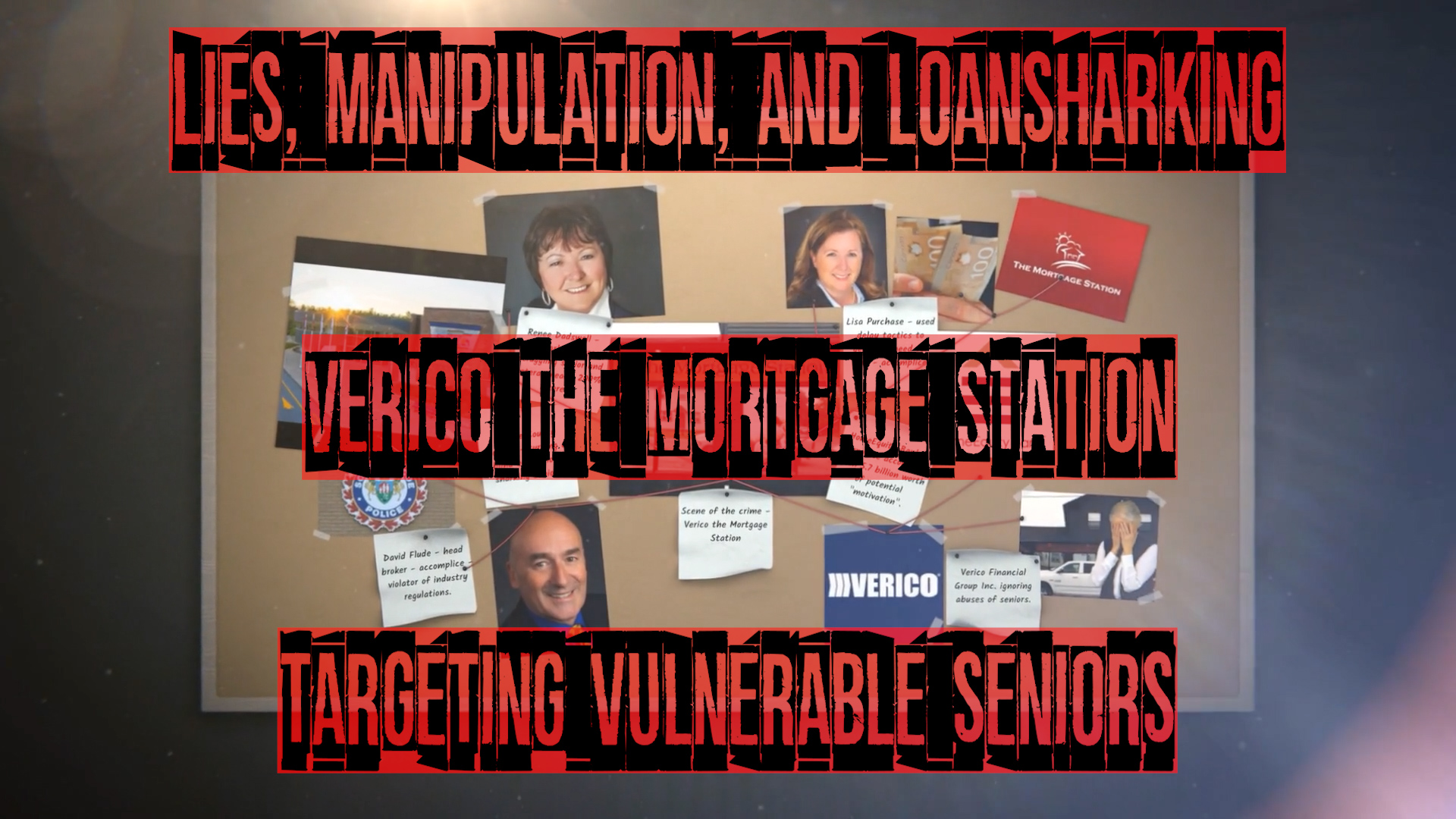

As the weather has worsened, more people are staying at home and browsing online. This is especially true of seniors, who we are trying to reach as they are the potential targets of abuse of trust and loan sharking by the brokers at Verico the Mortgage Station.

So, as was promised a few months ago, we are now boosting some of our earlier videos.

The first video to revisit is Lies, Manipulation, and Loan Sharking - Verico the Mortgage Station - Targeting Vulnerable Seniors. That video was popular when we first released it, having been viewed on Facebook and our website by more than 5,000 people. So, about a week later, we released it again to an audience exceeding 7,000. The second week suffered poorer weather, which explains the increase.

In that video, using his own emails as evidence, we showed how David Flude, the Principal Broker at Verico the Mortgage Station, lied at a pathological level, six times in two emails, to evade what he called a 'regulatory required' review of the tactics used by brokers Renee Dadswell and Lisa Purchase to defraud a senior and veteran through loan sharking that was required to be submitted to Financial Services Regulatory Authority of Ontario (FSRA) but never was.We think our new Search Engine Optimization techniques, combined with those of our unidentified online promotions expert, are working very well as now, instead of worrying about competitors, the brokers at Verico the Mortgage Station have to deal with the truth of their criminal offences being released to the public, which for 18 months, they have chosen not to challenge in any way. There have been no lawsuits, no angry emails from lawyers claiming defamation, and no court filings seeking injunctive relief.

You don't have to be a lawyer to understand why the owners of a supposedly 'trustworthy' business would choose to hide rather than stand up and defend their 'good' name.

The competing broker shown here, that we will not name out of respect, is a well-established and prominent mortgage broker in Simcoe County. However, now their SPONSORED ad, which they have paid for, comes up on Google AFTER our SIXTH reference when looking up 'the Mortgage Station'.

It is little wonder why so many people are thanking us for exposing these criminal abuses of trust about loan sharks who target potentially vulnerable seniors.

This competitor's paid advertisement does not follow our first reference on Google, but our SIXTH. There is little wonder so many people are finding our reports and evidence, and then going somewhere other than Verico the Mortgage Station to arrange a mortgage.

We are very happy to be able to confirm that our host for this documentary, a former journalist with one of Canada's biggest broadcasters, is freed up from contractual obligations to conduct interviews in our studio and on location during the week between Christmas and the New Year.

Those on-camera conversations involve people who have stories relevant to their experience working with the brokers at Verico the Mortgage Station, and at least one as yet unconfirmed former employee of HomeEquity Bank who says they left their position for ethical reasons.

We must admit a high level of surprise when just yesterday a former client of Scotiabank told us they wanted to chat about their experience with that lender. We are currently sifting through their documentation.

We will be in touch with all these potential sources of insider information to arrange a time and place that works for them.

Interviews are moving forward during the week between Christmas and New Years.

So, today, we started the process of optimizing the YouTube videos associated with our ongoing articles in support of our documentary about loan sharking and mortgage fraud as undertaken by brokers of Verico the Mortgage Station in Lefroy.

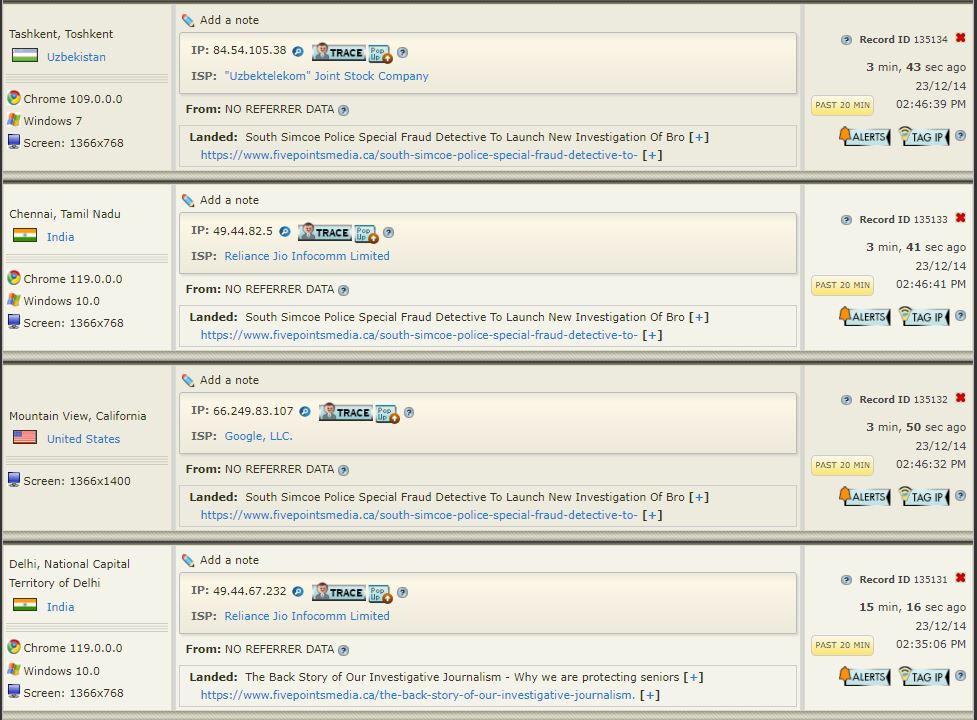

The immediate response was a sudden flurry of activity to every page associated with the changes, which are these three records of a visitor to our website and about 20 more pages.

This is an automated response using proxy servers redirected to our reports from all over the world, and our best speculation is that they are either our new friend who is promoting our story, or a service hired most likely by Verico Financial Group Inc. or HomeEquity Bank so they can monitor the public relations disaster created by the loan sharks of Lefroy.

For details, please visit: https://www.fivepointsmedia.ca/anonymous-promoter-now-helping-us-to-warn-vulnerable-seniors-about-the-loan-sharks-of-lefroy.html

This data represents a small part of a twenty-seven page feeding frenzy that happened right after we optimized and standardized the SEO of our YouTube videos.