Verico the Mortgage Station - Loan Sharking in Lefroy

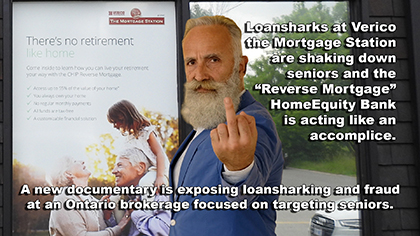

This documentary is being produced to protect often vulnerable seniors from being defrauded.

Despite the fact that we have made multiple offers to interview the accused,

none of our allegations have in any way been contested.

The above window contains a playlist of multiple videos.

Select your choice in the upper right corner.

The associated articles and evidence are included below.

You are being automatically forwarded to current page on the new website that is dedicated to this documentary. If this does not occur, please click here

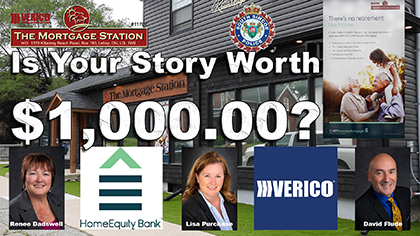

A little more than a year ago, in March of 2022, our producer, John Ironside, an internationally experienced journalist and producer of documentaries, applied for a mortgage with Verico the Mortgage Station, located in Lefroy. He ended up agreeing to accept a CHIP Reverse Mortgages, offered by the HomeEquity Bank, which is owned by the Ontario Teachers’ Pension Plan Board. He was assured by broker Lisa Purchase that the process would take three weeks, which fit with his existing obligations.

Nine weeks later the mortgage had still not cleared, as the brokers of Verico the Mortgage Station created one excuse after another to perpetuate the confidence grift and stress out the team's mark.

Every time the “guaranteed” date was reached “something came up” to prevent it. Then Lisa Purchase presented various other mortgage options; always at greatly increased rates of interest and higher brokerage fees. Then came the scam to force their mark to accept borrowing money at illegal rates, known as usury, or more commonly called loansharking.

Our story is not about a $500.00 grift, but focuses on the risks to often vulnerable seniors who are unknowingly entrusting their life savings and homes to self-serving con-artists who will stoop so low as to commit crimes like fraud, breach of trust, and loansharking to take money from their elder clients.

John was in the middle of renovations as he was building media studios in which our not-for-profit community channel, Five Points Media, would produce studio-based programming for area charities, not-for-profits, and benevolent groups. Lisa and the other brokers at Verico the Mortgage Station knew that their intended mark was a true philanthropist who had donated more than $600,000.00 in services to our community and that he was responsible for having helped raise hundreds of thousands of dollars for various charities. Regardless, the brokers at Verico the Mortgage Station threw up every roadblock imaginable and always without explanation to force their mark to accept the higher rate options. They even told John in writing that he could not borrow money from a third party without hindering the mortgage process.

In the end, with no other way of covering his debts, and as his kitchen had been removed in anticipation of funds and the studio was incomplete and could not be used to earn a living, the brokers at Verico the Mortgage Station offered to provide their mark with a loan for $2,000.00 from another broker named Renee Dadswell. The catch was that the loan was conditional upon the victim of their confidence scheme “agreeing” to pay the illegal usury, or loansharking, rate of 120% interest. When the mortgage finally closed, 46 days after the loan was received, the brokers of Verico the Mortgage Station helped themselves to $2,499.75, which was the principal, plus $299.75 in interest for a loan of 46 days, and also a service fee of $200.00 that was never part of any agreement. The brokers simply skimmed what they believed was "their cut" out of the mortgage disbursement like it was their right to steal whatever they wanted.

Now we are telling the story through an exposé documentary for broadcast across Canada and streaming around the world, and we are learning that our producer is most definitely not the only victim of these kinds of tactics used at Verico the Mortgage Station. The brokers are also now under investigation by the South Simcoe Police Service, who brought in a fraud specialist detective only after our producer pointed out what the first investigator missed or was "motivated" to ignore. He also chose to completely disregard the complainant during his investigation and spoke only with the brokers at Verico the Mortgage Station who he chose to believe had only charged 12% on the loan despite the very obvious and irrefutable evidence in the form of a bank statement and the disbursement ledger that was created by Lisa Purchase.

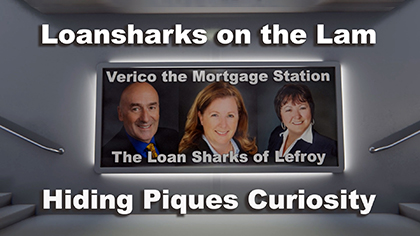

We have been telling this story for more than a year, and we are reaching thousands of local seniors and their families who are now forewarned not to deal with the brokers of Verico the Mortgage Station. Regardless, neither the brokers of Verico the Mortgage Station, the directors of Verico Financial Group, nor the management of HomeEquity Bank have taken any action in civil courts, such as applying for a cease and desist order from the Superior Court. The reason for that is we have the evidence to support our claims, which is why they are all hiding from our cameras and the truth.

Our fully supported and uncontested stories are below.

This story of the loan sharking mortgage brokers at

Verico the Mortgage Station

is no longer being updated on this page.

Please visit the updates on our new domain at:

www.themortgagestation.tv

Verico the Mortgage Station

is no longer being updated on this page.

Please visit the updates on our new domain at:

www.themortgagestation.tv

As noted in our ‘Latest News’ section, dated December 28, 2023, the day prior our producer received via email a PDF file entitled “Libel and Slander Notice Ironside”. The document was written by somebody with little if any knowledge of the law, it was not signed, there was no name associated with the authorship, and the email address was generic.

The question we have to ask is who exactly is this ‘brave’ and ‘bold’ issuer of ridiculous rants who hides in the shadows and is too scared to affix their name to their own threats?

Through our research regarding Search Engine Optimization, we learned that maintaining and frequently updating a subject-relevant blog is one of the best ways to attract the ‘robots’ and ‘spiders’ of the search engines, which improves your website’s footprint on the Internet.

So, we thought we would kill two birds with one stone.

Our new Daily Updates page includes short stories and pertinent facts that are better suited to short posts rather than full reports or articles. It will be updated more frequently than adding new pages and will be organized with the most recent updates at the top.

A few of our regular followers immediately noticed that last night we made some minor changes to the operational side of our website, most obviously in the form of a date-optimized drop-down menu. We did this to gain room for more articles and videos, as clearly, the brokers at Verico the Mortgage Station are intent on continuing to hide from their own criminal and ethical abuses, and it now seems inevitable that this story will go the long way around to get to the full truth. That is 100% their choice, and clearly, they don’t care if their mortgage funding companies get hurt in the process, as has occured to HomeEquity Bank.

These lenders and the shareholders who finance them also have a right to know the truth about those with whom they do business.

Regardless of this wall of denial, we are moving forward, and on Friday, December 8, 2022, we exercised our right as journalists to contact the various lenders who provide mortgage funding to the clients of Verico the Mortgage Station. We would have preferred to leave them out of this, as they are not direct parties to the crimes, but then we realized we have an obligation past that of just the potentially vulnerable seniors who buy CHIP Reverse Mortgage from the see-no-evil HomeEquity Bank.

These lenders and the shareholders who finance them also have a right to know the truth about those with whom they do business.

Most people know that con artists and cowards walk hand-in-hand. Look no further than George Santos, who quite rapidly went from being a shining new star of the freshly minted GOP majority to that of an expelled formerly “honourable” member of the United States Congress.

If either of these stories sounds familiar, it is likely because you read something similar here in our ongoing reports about how the brokers at Verico the Mortgage Station committed the indictable offence of usury, also known as loansharking, against a senior and veteran. Then, they lied, hid, violated “regulatory requirements” and even ‘motivated’ local police to omit evidence in a plot to escape accountability for their crimes, which under the Criminal Code of Canada carry a punishment of up to five years in prison.

Every day, lawyers are retained by individuals and corporations to sue others for defamation, which is defined as: “the act of communicating false statements about a person that injure the reputation of that person.” Few solicitors decline to accept a retainer for these civil claims, as they are usually easily proven.

Based solely on the very public allegations made by our team, in our own names, most lawyers would assume a claim by either the brokers at Verico the Mortgage Station or the Board of Directors of HomeEquity Bank would be a slam dunk. After all, what kind of financial service, which works on trust, would not defend against allegations of loan sharking, lying at a pathological level, and evasion of the very government regulatory requirements that are intended to protect the public from what we are reporting were undertaken by the brokers Verico the Mortgage Station and ignored by the board of directors of the HomeEquity Bank?

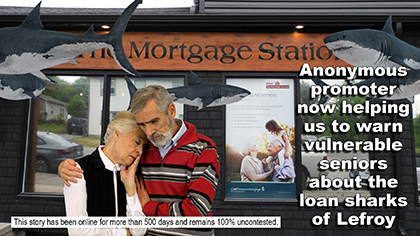

In this segment, entitled “Anonymous Promoter Now Helping Us To Warn Vulnerable Seniors About The Loan Sharks Of Lefroy”, we discuss how an unidentified expert in Search Engine Optimization is covertly helping us to improve the reach of our various videos and articles by using a state-of-the-art technique known as "long-tail keywords". The results, so far, have been nothing short of remarkable, as now our facts and evidence about Verico the Mortgage Station and their profit motivated allies at HomeEquity Bank are coming up aces on page one of Google and other search engines. This will enable us to warn more potentially vulnerable seniors about the risks posed to their financial security by the brokers of Verico the Mortgage Station and their 'turn a blind eye' allies at HomeEquity Bank, the providers of the CHIP Reverse Mortgages

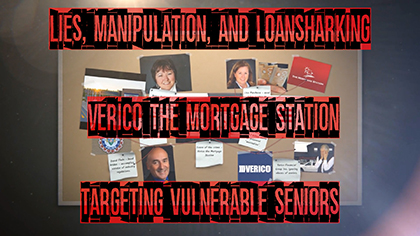

In this segment, entitled “Lies, Manipulation, and Loansharking”, we show how after committing the indictable offence of usury, or loan sharking, the brokers of Verico the Mortgage Station were called upon to prove the validity of their actions to their governing body, the Financial Services Regulatory Authority of Ontario (FSRA). However, instead of substantiating their illegal actions, they simply walked away, ignoring what they admitted were “regulatory requirements” that are intended to ensure they are honest enough to maintain their license.

Many in Simcoe County now know our story about how detectives of the South Simcoe Police Service omitted evidence and figures through deliberately inaccurate calculations to ensure that the wealthy and well-connected brokers of Verico the Mortgage Station were not charged with committing the criminal act of usury, or loan sharking, against potentially vulnerable seniors. Details can be found at https://www.fivepointsmedia.ca/south-simcoe-police-service-now-omitting-and-falsifying-evidence-to-protect-loan-sharks.html

Earlier this month, our producer, a former international journalist and technical support specialist for private investigations, replied directly to the detective’s deception, and when doing so he copied every member of Simcoe County Council to the email.

Christmas is coming, and in today’s economy, who can’t use an extra hundred dollars? Even better, you would be winning that money by helping protect vulnerable seniors from the threat of financial fraud. We need your help to spread the word about our efforts to shut down loan sharks who prey on seniors in Simcoe County. That could be your parents or grandparents, aunts and uncles, friends, or just seniors you know. So, each month, during the time we are working on this project, we will give away one gift card valued at $100.00 to the top provider of likes, shares, and group posts that promote our journalistic exposé. The stories to be promoted can be found at www.fivepointsmedia.ca/loansharks. If you know your way around social media, you could share our stories in a hundred places in an hour.

Our team at Five Points Media is producing an exposé documentary about fraud through usury, or loan sharking, that is being used against seniors and veterans in Simcoe County. For the back story watch https://www.fivepointsmedia.ca/south-simcoe-police-service-now-omitting-and-falsifying-evidence-to-protect-loan-sharks.html

This indictable offence, which is punishable by a prison sentence of up to five years, was committed against a senior and veteran by the mortgage brokers at Verico the Mortgage Station. We are also exposing why the detectives and top brass at the South Simcoe Police Service are transparently protecting these wealthy and influential brokers who claim sales of five to six million dollars a year. Details can be found at https://www.fivepointsmedia.ca/south-simcoe-police-service-cook-the-books-to-help-rich-crooks.html

We know this is a weird thing to say, but today our Producer had a Zoom meeting with a Producer and financier of social documentaries, and if our lawyer says it is good, then we have more than enough money available to produce our ongoing documentary about loan sharking at Verico the Mortgage Station. We will also be addressing how Verico Financial Group turned a blind eye, how HomeEquity Bank showed no concern for the financial security of their often vulnerable senior clients, and how the South Simcoe Police Service have been going out of their way to just ignore the facts and evidence in this case while becoming increasingly creative in how to justify the obvious crimes committed. Our new best friend was impressed with how fast the story has developed, and what we have kept back for now about a few things local residents and the population at large should find very interesting.

Reaction to our most recent video, found at “South Simcoe Police Service Now Omitting and Falsifying Evidence to Protect Loan Sharks”, has quite clearly caught the attention of tens of thousands of Simcoe County taxpayers, and with good reason.

We have shown through the presentation of evidence that detectives and top brass at the South Simcoe Police Service seem very eager to protect the loan sharks at Verico the Mortgage Station, as they have so far tried to ignore the claims of criminal activity, and then dismiss the fully supported allegations, and most recently omit the facts and alter calculations in favour of the accused.

At what point do the one-sided and blatantly biased actions of a police department become an act of obstruction of justice, and when does a detective become so motivated to help the criminals that he becomes an accomplice after the fact?

These are the questions we are now researching and bringing to light after a special fraud detective assigned by the South Simcoe Police Service to review the case of usuary committed by the wealthy brokers of Verico the Mortgage Station told our producer that he is omitting key evidence based on nothing but his personal desires while also knowingly using the wrong mathematical formula that will alter the rate of interest charged so that it does not appear to be usury or loan sharking. The first action is unethical, while the second is a crime.

Under Canadian criminal law, individuals who facilitate or assist in the execution of a crime are treated as culpable as the person who physically carries out the act. This principle is commonly known as “aiding and abetting”. Individually, they are defined as: “Aiding is assisting, supporting, or helping another to commit a crime. Abetting is encouraging, inciting, or inducing another to commit a crime. Aiding and abetting is a term often used to describe a single act.” So, you ask, how does this relate to this story?

Well, if it looks like a duck, swims like a duck, and quacks like a duck, then it probably is a duck.

HomeEquity Bank Turns To Censorship - Far Too Little, and Much Too Late

A Pathetic and Futile Attempt to Silence the Truth

Last night, July 22, 2022, we were advised by Facebook that the HomeEquity Bank had filed a copyright complaint against several of our posts, with the goal being to hide them from the public and their existing and potential clients. This must be the weakest and most pathetic action ever taken by a bank to silence the truth and stop public questions about their ethics and trustworthiness.

The strong stand tall in the light of day while the weak and guilty lurk in the shadows.

So, to be clear, for about a month we have been publicly questioning the ethics of the HomeEquity Bank, which is owned by the Ontario Teachers’ Pension Plan Board, and which boasts assets exceeding $5.7 billion.

Five Points Media - Who We Are

Why we are exposing the crimes committed by brokers at Verico the Mortgage Station

We have noticed a trend amongst the many visitors who are now coming to our website repeatedly, sometimes several times on the same day. They often review an article, linking to it from social media, a search engine, or an email or other link, and then they go to our “Testimonials” or the “Our Team” page. Sometimes they go to our commercial services website and review the counterpart pages there. This is natural as people want to know who is making the allegations.

However, when we see the same visitor go to those same pages eight, nine, ten, or more times, it becomes clear that they are trying to figure out for themselves who we are and if we are telling the truth.

The stain of corruption is spreading rapidly to both Verico Financial Group and HomeEquity Bank, which created the CHIP Reverse Mortgages that is targeted at seniors who own their own homes. Both are coming in hot with Google and other search engine results, mostly due to the traffic being drawn in by concerned seniors and groups, with a little help from our new SEO tools that are working very well.

Good companies that continue to associate with criminals will be painted as accessories or aiders and abettors.

The game of living on the lam continues as those who fail to represent Verico the Mortgage Station, Verico Financial Group, and the HomeEquity Bank refuse to stand up and support or explain in any way how it is acceptable to them for provincially licensed mortgage brokers to defraud clients through loansharking and skimming from mortgages. So far, only a single Director at HomeEquity Bank has thought to give our producer a call and discuss the matter. However, even when his questions were answered, and he was told the details, the Director again refused to agree to an interview that we sought with the President and CEO Steven Ranson.

They all know we are telling the truth or one of these multi-million and billion-dollar corporations would have filed an action in the Superior Court seeking a cease and desist or other injunctive relief.

On June 11 and 12, we sent the email included below to a list of brokers and brokerages that operate under the Verico flag in Ontario. Clearly, from our visitor logs, many of them shared the details of our pending documentary with associated brokers in other cities and provinces, as we had hits come in from all sides, east to west.

We are now compiling the list of all Verico brokers to whom we will be sending our introduction, as well as to others who are not associated and who are their competitors.

We are sure that it will come as a surprise to absolutely nobody that the HomeEquity Bank declined our request for an interview with Steven Ranson, President and CEO, regarding the tactics of profiteering through loansharking and fraud that have been exposed and substantiated as being committed by brokers at Verico the Mortgage Station while selling the “CHIP Reverse Mortgage” to potentially vulnerable seniors.

How many people would idly do nothing as hundreds of dollars were stolen from their bank account?

Five Points Media was created in 2014, nine years ago, and some of our videos have drawn more than 50,000 views. However, despite the longevity and popularity of those productions, after just two weeks our page entitled “The South Simcoe Police Service is Protecting a Loanshark” has leaped ahead to become the most popular page on our website other than the home page. Of our top ten pages, the index page of this story about Verico the Mortgage Station, found here, comes in at number six of more than 300 pages.

We have recently learned that a prominent group that is focused on the issues of seniors is sharing our articles via email, apparently to a lot of people who are concerned about elder fraud.

The Back Story of Our Investigative Journalism

Why we are protecting seniors from the loan sharks at Verico the Mortgage Station

On Thursday, June 29, we released through Facebook the video entitled “Fraud Warning For Seniors In Simcoe County!” and then we posted it on our website. The result was much better than we had expected for the beginning of a long weekend. This was the fourth story and video we have published about Verico the Mortgage Station this year, plus the three we shared a year ago. So far, none of the brokers of Verico the Mortgage Station have taken any action to prevent us from publishing these factual reports, and none has shown the courage to step up and tell us their side of the story on camera.

We were also asked by a reader who claims to work in the mortgage industry

'why is no other local media outlet covering this story,

and why are the brokers so clearly hiding?'

A special investigative detective, trained in financial crime and fraud, has been assigned by the South Simcoe Police Service to review fully supported allegations of usury, or loansharking, that were committed in Innisfil.

When advising us of his decision "I have undertaken to have this thoroughly reviewed by our fraud investigator", Inspector Fernandes of the South Simcoe Police Service described the specialist detective as ". . . has extensive training and experience involving high level, high monetary value, and complex fraud investigations . . ."

It was on June 22, 2023, less than a week ago, that Inspector Julio Fernandes of the South Simcoe Police Service sent a haughty and indignant email that finalized with the words: “Your claim of a criminal interest rate is unfounded, and it has been determined that you are not the victim of a crime (criminal offence).” Yesterday, after we had released our irrefutable evidence to the public and to all of Innisfil Town Council, he wrote to me again, but this time in a very apologetic manner full of promises and requests for “patience” as he notified me: “With the additional information and attachments that you have provided in your last email, I have undertaken to have this thoroughly reviewed by our fraud investigator . . .”

What a difference a week can make when the public is informed, and the secrets are exposed.

Are the loansharks at "Verico the Mortgage Station" a financial risk to seniors?

We asked Steven Ranson, Pres./CEO, of HomeEquity Bank CHIP Reverse Mortgage

The brokers at Verico the Mortgage Station trade heavily in the setup of CHIP Reverse Mortgages offered by the HomeEquity Bank. This means they attract seniors who want to stay in their own homes throughout at least most of their retirement. So, you would think that the Detective, Inspector, and Chief of the South Simcoe Police Service who are choosing to ignore the evidence of loansharking, as committed by Renee Dadswell, a broker at Verico the Mortgage Station, would be a bit more concerned about ensuring that seniors are not defrauded of their life savings.

Today, we emailed Mayor Dollin and carbon copied every member of Innisfil City Council advising them of our documentary and providing some details of the multi-level cover-up that seems to be happening at the South Simcoe Police Service. Obviously, our goal is to ensure that this story, which focuses on affluent and influential members of Innisfil’s business community, is not just brushed under the rug as seems to be the intent.

The law applies to everybody, and no amount of shuffling, ignoring, or denial is going to make this story or us go away.

A little more than a year ago, we posted a story called “Loansharking in Lefroy?” It can be found at HTTPS://www.fivepointsmedia.ca/verico-the-mortgage-station-loansharking-in-lefroy.html. To this date, 370 days later, no representative of Verico the Mortgage Station, the company at the center of allegations of usury, has taken action to remove our allegations. If we were lying or inaccurate in our claims, lawyers for this provincially regulated financial company could have silenced us through a cease-and-desist order through legal action in the Superior Court. They could have also attained an order of costs against us and demanded that we post a retraction and an apology.

Don’t you want to know why this business that works on trust regarding your finances did nothing to protect its “good” name?

For most individuals and families, the decision to buy a house is the biggest investment of our lives. So much can go wrong, so when it comes time to take the plunge, we need to know we can trust the broker who will arrange our mortgage, and that they will always have our best interests at heart.

What we do not expect is that the broker will take three times as long as they promised to close the mortgage, that they would disregard multiple dates by which they promised to have everything done, or that they will be cavalier about how their very evident negligence or incompetence is costing their client, a benevolent not-for-profit, thousands of dollars every week that they stall the process.

Worst yet, you do not expect to discovering that the broker you thought you could trust was charging you usury levels of interest on a loan that is the textbook definition of loansharking.